This is Steve Jobs’s home.

There are only a few things, a portrait of Einstein, a desk lamp, a chair and a bed.

As a minimalist, he has applied his minimalism to everything.

Meeting: never invite any unrelated staff

Mobile: keep phone as the only keyboard

Dressing: black top + jeans

When Lisa recalled her father, she said his life philosophy was self-restraint, asceticism and minimalism. Jobs believed that asceticism and minimalism would make people more agile, discipline would generate pleasure.

Traders usually say you only take one scoop of water out of the whole ocean. But Mr. Market quotes every 5 minutes under your nose or even quotes every second, and it’s tough to stay still.

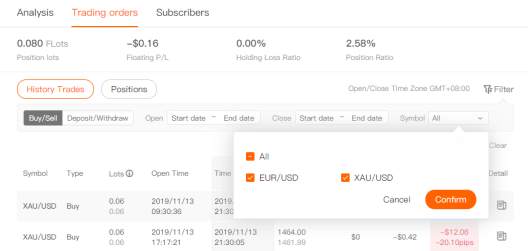

Smart traders will do subtraction on categories. @落落野花 is such a trader, he has traded thousands of millions of categories, but he has a unique passion for gold and euro. From the first trade on June 3, 2019, he only trades EUR/USD and XAU/USD. Now he’s still doing the same.

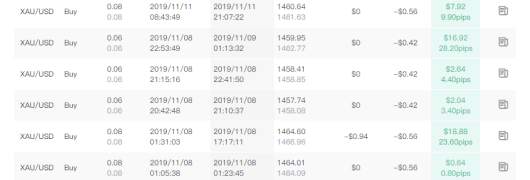

In an environment where most people manage to stop for profit, let the loss run, the trader does the opposite, and he only does the half – stop the loss. Enter with a stop, and this is standard. We are still lacking in letting the profit run, such as the orders below:

On the other side, when holding a position, we fail to see the truth easily because we are in it. While the short term has its advantage, it will make a net value curve brighter.

Now, after five months, the performance is not bad, revenue is $2662.12 and the rate of return is 130.34%.

It’s worth noting that some traders will do better as time passes, but some traders will be out of control because they failed to resist the temptation. Making a profit for over half a year but lost in three days, there are thousands of examples.

The German philosopher Martin Heidegger has discussed the concept of death using rational reasoning in his ontology book <Being and Time> and ultimately answered how people should face inevitable death: the countdown in life meaning -- Being-toward-death.

In a zero-sum market, the key to traders’ survival is - - not to become a loser.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()