Stubborn as you are, you probably think you are knowledgeable and have a unique vision. Your consciousness tells you that Euro is at the bottom and gold is undoubtedly going up. But you are too confident at that time, and then you heavily weighted, after forced liquidation, the quotation goes as scheduled. Or probably you are not so sure, you could have made 10 times more profits out of the quotation, but you boast about your high “annual returns” when you just made 10%. This is typically arrogant and typical Mr. Kong yiji.

Or you might be a very patient person, you can sit before the computer and stare for hours. You are principled, you won’t open a position until it’s time for positions. But if you fail in the end, you likely think you are awesome all of a sudden. There’s no need to focus on one point, or one stop-loss/stop-profit point. In the end, you don’t even know how you account is being swallowed. This is called arrogance!

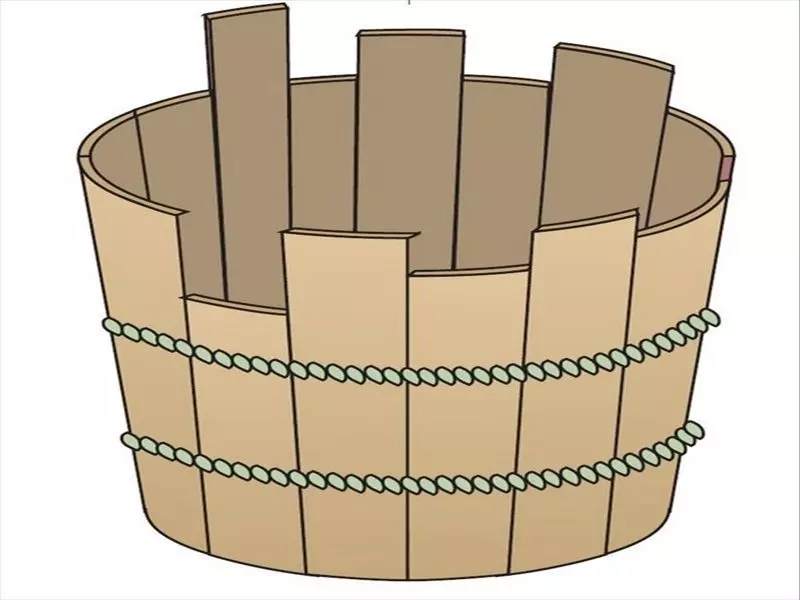

We all heard about the “buckets effect”. How much water a barrel can hold doesn’t depend on the longest wooden bars but the shortest. The stronger your barrel is, the easier there is shorter wood. FX is no different. The successful trade needs us to correctly open a position, correctly hold a position, successfully leave a market and accurately manage the fund. If one of the wooden bars has issues, trade failure will happen. To collapse, a mistake in one step is enough!

After five years of FX, what can I do if we keep losing? Where can I go? The answer to this question is that if you don’t understand the make-up of a barrel, and not able to analyze the reasons behind short wooden bars, don’t know how to build a barrel, then no matter how long you do FX, it’s normal you keep losing money.

Time is the crucial thing that people can’t ignore. If you want to define it in a word, you might not have the answer in a short time. Time is the carrier that carries all memories, and it is the experiences of a trader. If an experienced trader kept losing money and didn’t find out his own profit models, then what time brought him was pain and hardship. He will be super careful when opening or closing a position, the target profit is not about how much he could earn in a month, let alone numbers like “double”. He will be delighted if the annual return is 20-30%. That is why people tend to use the word like ten-year trading experience to deceive the others. Therefore, if you have been losing money for 5 years, I suggest you rest for a while and think about what to do next. Is it to continue or do something you like!

Fund management and functions of fund model are to control loss and increase the stability, not to make profits. Control loss: through the proportion of general positions to control losses, to ensure the unlimited iteration of trading. This is highly relevant to The Kelly Criterion. Under the condition of highly appropriate strategy, to take advantage of the fund position to ensure the most considerable possibility of unlimited trading iteration based on the loss expectation of strategy. Increase the stability: try best to increase security through diversification.

Spreading the fund into categories not related to the trading results as much as possible (this is also based on different strategies, I prefer to look for trading opportunities of varying currency pair rather than one currency pair), through loss and profit of different categories to hedge against and lower the risk of drawdown. At the same time, I can also adjust the trading position of different categories based on specific criteria. If there are a lot of trading capitals, we can do research on the diversification in one single category, for example, different periods and parameters, medium-term, short-term, long-term and daily line combination, etc. The criteria are “as long as you are happy.”

The scientific trading method. Keep the consistency, quantifiable scientific fund management strategy. For example, 1000 USD account was traded as 0.1 lot size, 10,000 USD account was traded as 1 lot size, these behaviours are the main reason for a more significant loss than expected. Besides, not setting up a stop is the most terrible fund management. Misusing the deposit is also not workable. Like the community user “Shuidongyijing” some time back. It’s best to quantify the investment, I saw a sentence some time ago in the comments section: I don’t believe human beings. Among all the variables, people are the most uncontrolled, but every currency pair has its own feature. The biggest variable is to add all the variables, if you can use a constant way to quantify and backtest some successful history, it can also be speculation.

People’s qualities, the development of society, the chaos of the industry, the FX trading market is becoming part of the mass investors’ cause. The obstacle of humanity is hard to cross over, yet there isn’t no solution at all. The indirect answer is one of the ways, as for morality and justice, the indirect method of sorting out humanity problems are the golden mean in trading: substitute time for space. We can’t resolve the basic issues like holding the orders or stop loss, can we? All the famous traders were severely defeated in the market because they keep holding the orders and didn’t set up a stop-loss point. If they did otherwise, how could they suffer a significant loss and quit the market? In front of money, human qualities and humanity, these unquantifiable things are the key.

I hope all the people who enter the market can build correct awareness and understanding. Don’t be after wealth but be a frank person. Five years are nothing, profit or loss doesn’t matter. People need some Buddhist nature. When you say no to temptation, you might be a step closer to success. May good people have a safe life!

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()