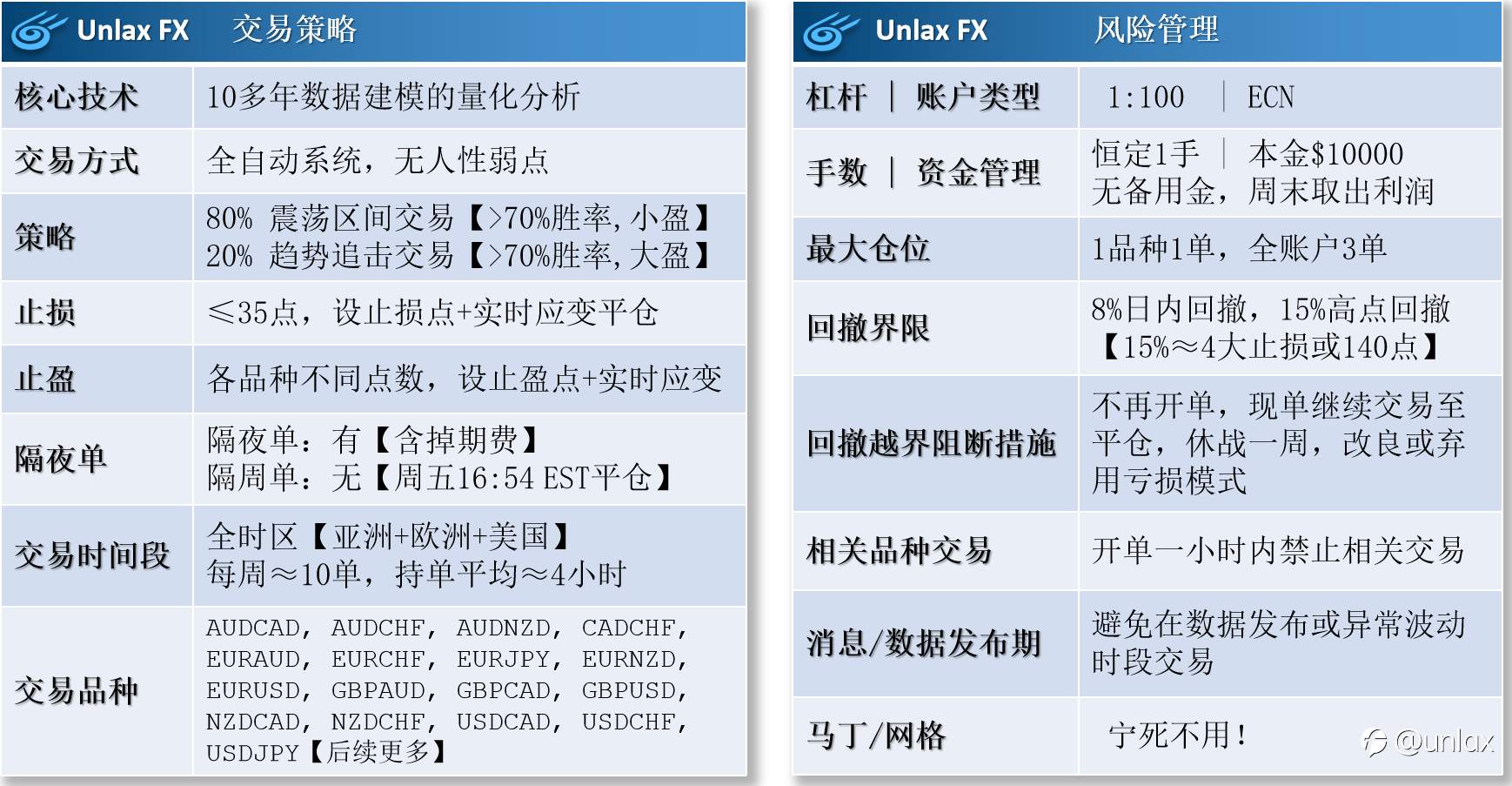

【交易策略与风控】

- 全自动量化交易系统,一万美元ECN账号用固定一手交易多达17外汇品种。约80%震荡区间与20%趋势交易。客户资金的风控为首要考量,禁止马丁、网格、扛单、浮亏就入金等操作。每个品种只开一单不加仓,全账号最多三单,开单一小时内禁止相关交易(如欧美&镑美),周末前必清仓,只需1:100的杠杆。

- 设止损是强制性的(掉期除外16:55-18:10 EST),止损都 ≤35点。止盈与止损点都设置在单上,也会实时应变而提前平仓。全日交易时间段(亚洲 欧洲 美国),平均持仓约四小时 ,每周约10单。区间策略都避免在数据发布或异常波动时段交易。

- 系统采用自动阻断机制执行账号风控。若遭遇日内回撤>8%或高点回撤>15%,将停止再开单,已开的则继续交易至平仓。每日回撤于18:00纽约时间重置。若高点回撤>15%,将暂停交易至少一周,人工改良模式并前测回盈才交易,若没法优化就果断弃用此模式。

- 策略研发采用量化技术分析,通过10多年历史数据建模,发掘并优化针对各品种的稳健盈利模式。本系统源于多年的回测,公式校准,前向验证,自动化错误处理以及在各种经纪商平台的实战。这不是单纯的MT4 EA,而是即可高质量且快速量化分析/回测,又能在多个不同交易平台操盘的综合系统,如我主页背景的架构图所示。

- 由于年中转为全职交易,开单的总头寸增至7.5手(本金$100000),分布于ICMarkets, Darwinex, RoboForex, AXI 的 MT4/MT5/cTrader平台(可查阅我的Myfxbook)。所谓身先士卒,任何亏损对我影响甚大,不像那些几百刀的马丁信号纯粹为了坑订阅费。风控与长期稳定盈利是中心思想,这点订户们大可放心。将会定期于周末取出利润,故此账号无复利(复利表面更牛但弊端也相对大)。

- 本人2008年开始人工操盘,2011转向自动化系统交易,已在国外多个跟单平台提供订阅信号和PAMM资管,后续我会发文阐述这些年的交易历程和战绩报告。

【订阅建议】

- 建议采用ECN或点差小的帐户以获取最大收益。交易品种的价差必须小于3点,越小越好。如果不确定,请跟我一样用IC Markets为佳。

- 手数按$10000:1手的比例,如$1000用0.1手 ,$100用0.01手。您也可根据自己的风控偏好做调整。我用这比例是为了控制回撤在20%内,和服务低杠杆的客户(1:100)。如果您用高杠杆(如1:500)或不介意大回撤,可用较大的比例跟单(如$1000用0.3手)。

- 信号进入回撤期时,请勿加倍跟单求翻本(马丁心态),这么说不是对自己没信心,而是敬畏市场,永远不要低估市场的逆模式周期会持续多久。

- 由于使用严紧止损点,被止损是正常的,如果您承受不了这种心理打击,请勿订阅。

- 本人技术宅一枚,不懂营销不玩套路,讲理仗义嫉恶,只要客户需求合理,我都尽心服务。

【常见问题解答】

- 每月回报率多少?

作为老实人我从不立flag,只凭历史数据说话,每月平均5-6%(16月内成长95%TWR)。过往战绩不代表未来表现,但现在我靠交易维生了,会更努力改进策略。

- 为何交易品种这么多?

别把鸡蛋都放一篮子,当某品种出现异常走势时停止其交易,且只取每品种最佳的出入场信号,既能分散风险,又能维持交易频率不用空仓坐等(得考虑付费订户)。那些鼓吹专注一两品种的要嘛是马丁,要嘛没能力驾驭多品种。

- 为何仓位这么高?

每品种只开一单不加仓,全账户最多三单,止损≤35点,最坏情况只亏105点,把控单日回撤8%,高点回撤15%,只用100倍杠杆,历史回撤<22%(不靠入金的真实回撤)。层层风控措施下干嘛要降低仓位?杠杆交易就得充分利用它却不滥用。只有浮亏不停加仓的马丁网格才会鼓吹低仓位。

- 为何盈亏比偏低?

盈亏比高(>1)的是趋势策略,占总交易的20%,这种交易出现率很低,与其空仓坐等,不如用频率高、风险低、盈润小的震荡区间交易填补空窗期。若只等高盈亏比交易是浪费资源,空仓躺着的钱无法替你挣钱。所以不能以盈亏比评价本系统,回报率+风控回撤才是。

- 为何成长曲线那么崎岖(马丁曲线多美啊)?

因为严紧止损,加上2020年尾至2021年初的市场走势异常。换个角度看,多少信号存活一年多还有这样的回报率+回撤风控?FM曲线只显示平仓后的净值,那些扛单的只要扛过了就完美曲线,扛不过就断崖爆仓。若那是您追求的,我无话可说,出门左转。

- 为何跟随总收益是负两万美元?

因为一位长期大倍数跟单的大佬在我回撤期时再加倍跟单企图翻本,结果回撤期持续,他的亏损翻倍,而我的回撤保持在<22%内。然后我回盈时他停止跟单好一阵子,所以对照两人的曲线明显大落差。最近三个月免费订阅多少有弥补这位大佬的意思。

- 为何免费(便宜无好货)?为何收费(真厉害就不用捞订阅费)?

怎样做都有人喷,免费是希望更多朋友观摩了解本信号,订阅费将根据信号表现而调整,绝对平民价不坑人,订阅保障会一直开着。没人能一直预判市场走势一直躺赢,股神杰西·利弗莫尔也大起大落破产多次。不拒绝任何不违背良心挣来的血汗钱。

以下的总结卡方便参阅与下载:

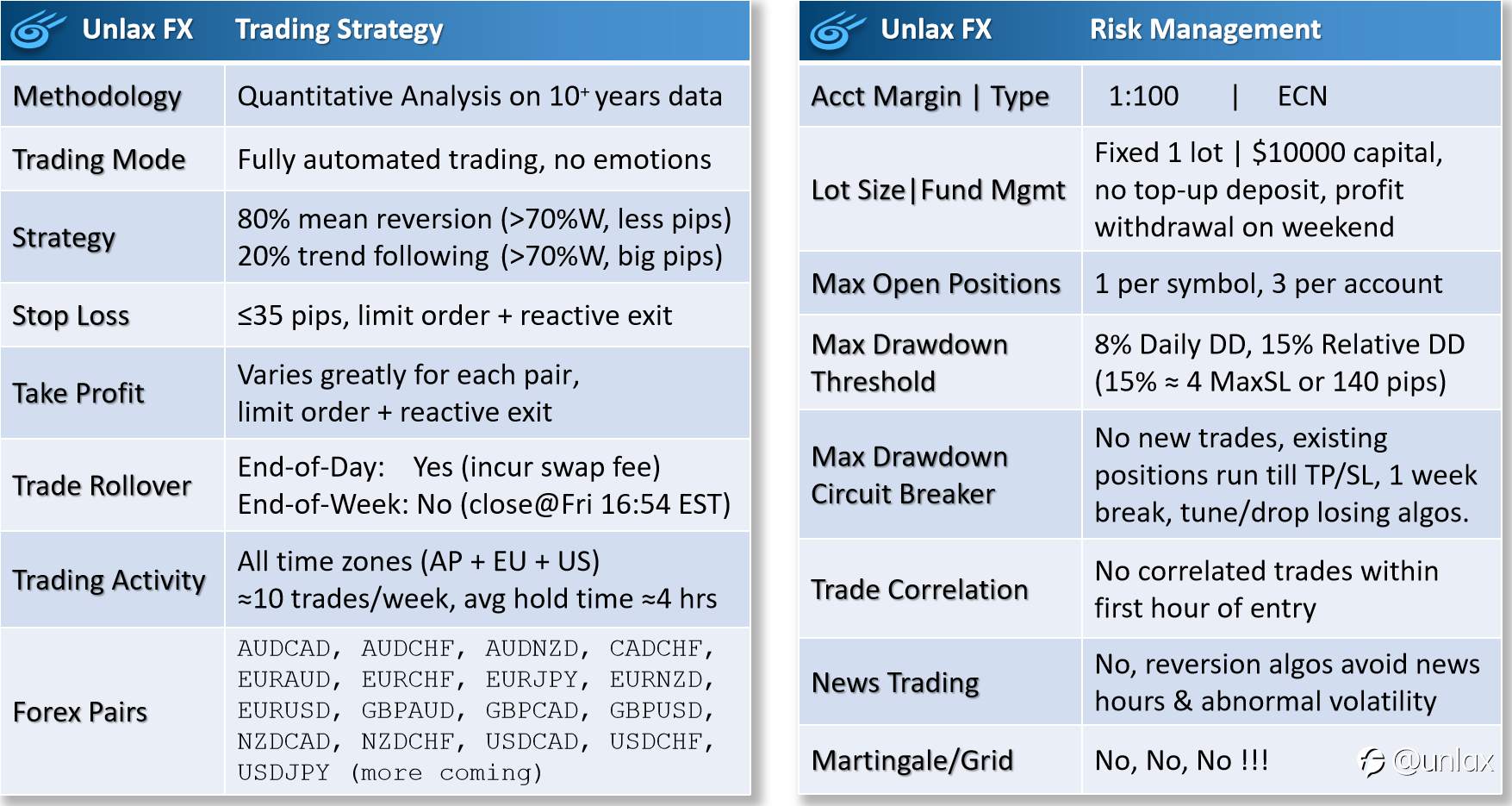

【Trading Strategy & Risk Control】

- Fully automated quant trading system uses fixed 1 lot on $10000 capital across 17 FX majors/crosses. Strategy comprises about 80% Mean Reversion & 20% Trend Following trades. Risk management of clients' money is utmost priority, so strictly No Martingale, Grid or Top-up fund. 1 open position per symbol, max 3 open positions per account, no correlated trades within first hour of entry (e.g. EURUSD & GBPUSD), all positions closed before weekend. Requires only 1:100 account leverage.

- Stop loss is mandatory except during rollover hour (16:55-18:10 EST), all pairs SL ≤35pips. SL & TP use limit orders as well as reactive exits based on current market strength. Round-the-clock trading over all time zones (Asia/Europe/US), average holding time 4 hours, about 10 trades per week. Mean reversion algos avoid news trading & abnormal volatility.

- System uses automated circuit breaker to manage account risks. The threshold is 8% Daily Drawdown & 15% Relative Drawdown. If threshold is breached, no more new trades but let existing positions run till TP/SL. DailyDD resets at 18:00 EST everyday. If RelativeDD>15%, pause trading for at least a week to re-tune algos and forward test, resume trading only when updated algos are winning again, or delete irrecoverable algos.

- Trading methodology is Quantitative Analysis, using data analytics to discover consistently profitable price patterns over 10 years of historical data. It evolves from many years of back-testing, formula calibration, walk-forward validation, automation error handling & live trading with various brokers. This is not a simple MT4 EA, it integrates high quality/speed quantitative analysis & backtesting seamlessly with automated live trading on multiple trade platforms, as shown in the architecture diagram on my homepage background.

- Since turning full-time trader in Jun 2021, my combined lot size is now 7.5 lots on $100000 capital distributed across ICMarkets, Darwinex, RoboForex, AXI on MT4/MT5/cTrader platforms (you can check Myfxbook profile). Hence I eat my own dog food, any losses is significant to me, unlike those Martingale signals using few hundred dollars to scam subscription fee. So rest assured that long-term profit stability & risk control is top priority here. Profits will be withdrawn over weekend, so this account ROI is non-compounding (compounding appears impressive but has drawbacks).

- I started manual day trading since 2008, switched to automated trading in 2011, provided FX signals on many copy trading platforms and managed PAMM account. I will post my trading history and performance in a subsequent post.

【Followers Guide】

- ECN or tight spread accounts are preferred to maximize gains. The spreads for the traded pairs must not exceed 3 pips, the smaller the better. If you are not sure, please use IC Markets (same as us) for best results.

- Lot size ratio should be 1 lot per $10000 capital (i.e. 0.1 lot per $1000, 0.01 lot per $100). You may vary based on your risk appetite. We use this ratio to control drawdown within 20% and support low leverage clients (1:100). If you have higher leverage (e.g. 1:500) and not concern with high drawdown, you can use a larger ratio (e.g. 0.3 lot per $1000).

- When experiencing drawdown, do not increase lot size multiplier to recover losses (Martingale mentality). We need to respect the market, never underestimate how long abnormal market conditions may last.

- As tight SL is used, getting stopped out is normal behavior, if you can't take the emotional hit, please don't subscribe.

- I am a candid, reasonable, non-salesy, techie guy, and will do my best to service clients with reasonable requests.

Below is summary card for your easy reference & download:

已编辑 01 Nov 2021, 21:28

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()