| Scenario | |

|---|---|

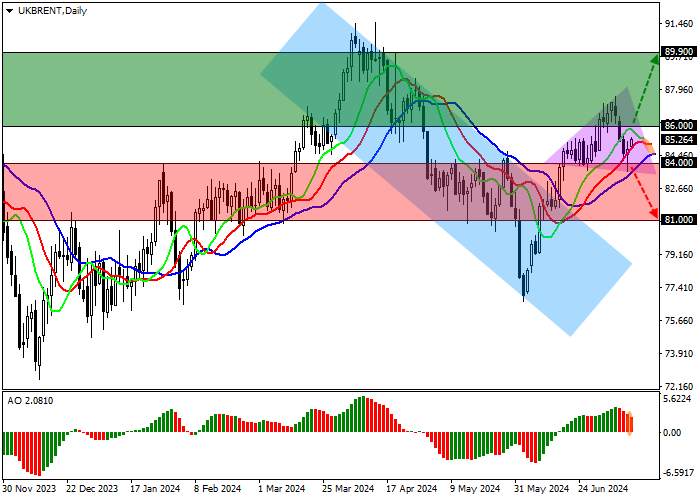

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 86.00 |

| Take Profit | 89.90 |

| Stop Loss | 85.00 |

| Key Levels | 81.00, 84.00, 86.00, 89.90 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 84.00 |

| Take Profit | 81.00 |

| Stop Loss | 85.50 |

| Key Levels | 81.00, 84.00, 86.00, 89.90 |

Current trend

Prices for the benchmark Brent crude oil grade are correcting in a slight upward trend, accelerating growth after the report on the reduction of the US oil reserves, and are trading at 85.00.

According to the American Petroleum Institute (API), oil reserves were adjusted by –1.923M barrels after –9.163M barrels a week earlier, and the report of the Energy Information Administration of the US Department of Energy (EIA) reflected a change in the indicator by –3.443M barrels after –12.157M in the previous period, meeting the expectations of experts. Thus, the negative dynamics are developing for the second week, exceeding 15.0M barrels, which may become a harbinger of the beginning of a new stage of release of oil reserves from the US strategic reserve, which the presidential administration talked about last month.

As for the investment demand for oil contracts on commodity exchanges, according to the Chicago Mercantile Exchange (CME Group), the trading volume of oil futures at the beginning of this week amounted to 720.0K positions, which is an average figure for the end of June and significantly lower than the peak values of mid-June at 1.2–1.3M transactions per day. Thus, the decrease in reserves is accompanied by virtually unchanged trading volumes, which signals a low probability of forming a new global position and supports the current trend.

Support and resistance

On the daily chart, the trading instrument is moving in a corrective trend, retreating from the resistance line of the downwards channel 82.00–76.00.

Technical indicators weaken the buy signal: fast EMA of the Alligator indicator are above the signal line, and the AO histogram forms correction bars in the buy zone.

Resistance levels: 86.00, 89.90.

Support levels: 84.00, 81.00.

Trading tips

Long positions may be opened after the price rises and consolidates above 86.00 again, with the target at 89.90. Stop loss — 85.00. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 84.00, with the target at 81.00. Stop loss — 85.50.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()