| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 7610.0 |

| Take Profit | 7360.0 |

| Stop Loss | 7700.0 |

| Key Levels | 7360.0, 7610.0, 7720.0, 7905.0 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 7720.0 |

| Take Profit | 7905.0 |

| Stop Loss | 7620.0 |

| Key Levels | 7360.0, 7610.0, 7720.0, 7905.0 |

Current trend

Australia's leading economic index ASX 200 is showing a corrective trend near 7671.0 amid the situation on the domestic bond market and the Reserve Bank of Australia's (RBA) monetary policy decisions.

Thus, during the last meeting, the interest rate was kept at 4.35%, but the RBA Governor, Michele Bullock, noted that the main factors preventing further easing of monetary parameters are rising unemployment and rapid inflation. She said that if borrowing costs were adjusted now, there was a high risk that consumer prices would rise above the current 3.9% and the negative dynamics would accelerate, so the RBA's plan was to wait until the indicator returned to the target range of 2.0-3.0%, and then begin to gradually adjust the interest rate in a minimum step of –25 basis points.

Another factor putting pressure on the stock market is the upward correction in the bond market, where the yield on 10-year debt securities rose to 4.124% from 3.875%, on 20-year securities to 4.616% from 4.412%, and on 30-year securities to 4.637% from 4.423%.

The growth leaders in the index are AMP Ltd. ( 13.05%), Omni Bridgeway Ltd. ( 5.31%), Wisetech Global Ltd. ( 2.48%), G8 Education Ltd. ( 2.47%).

Among the leaders of the decline are Mirvac Group (–8.53%), Resolute Mining (–6.80%), Appen Ltd (–5.42%).

Support and resistance

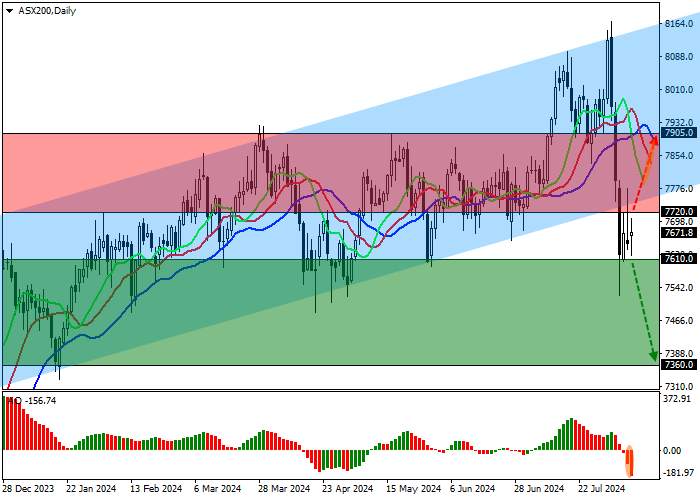

On the daily chart, the price is holding below the ascending channel with dynamic boundaries of 8160.0–7760.0, moving away from the support line.

Technical indicators have reversed and issued a new sell signal: fast EMAs on the Alligator indicator are moving away from the signal line, and the AO histogram is forming new corrective bars, being below the transition level.

Support levels: 7610.0, 7360.0.

Resistance levels: 7720.0, 7905.0.

Trading tips

If the asset reverses and declines with the price consolidating below 7610.0, short positions can be opened with the target at 7360.0. Stop-loss — 7700.0. Implementation time: 7 days and more.

If the asset continues growing, and the price consolidates above the resistance at 7720.0, long positions with a target of 7905.0 and stop-loss of 7620.0 will be relevant.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()