| Scenario | |

|---|---|

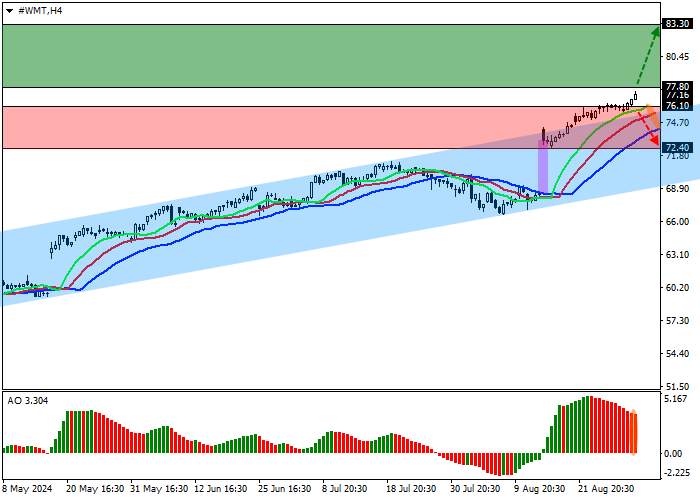

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 77.80 |

| Take Profit | 83.30 |

| Stop Loss | 75.00 |

| Key Levels | 72.40, 76.10, 77.80, 83.30 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 76.10 |

| Take Profit | 72.40 |

| Stop Loss | 78.00 |

| Key Levels | 72.40, 76.10, 77.80, 83.30 |

Current trend

Shares of Walmart Inc., an American company that operates the largest network of wholesale and retail trade, are trading at 77.00.

Several changes to be applied to trading platforms were presented at the Walmart Marketplace 2024 exhibition. Thus, it is planned to expand the categories of premium goods, used goods, and collectibles. Also, it is planned to develop an e-commerce program allowing placing orders from any site integrated into the system. In addition, the Walmart LocalFinds program for pickup and delivery from physical stores will be launched.

Amid the prospects for the corporation’s development, leading analysts have revised their estimates for the issuer’s securities. Evercore Inc. experts raised their target price from 78.0 dollars to 80.0 dollars earlier, maintaining their rating at Upperform. Economists at D. A. Davidson & Co. left it at the Buy level, with the target at 85.0 dollars. KeyBank representatives consider the outlook positive, confirming their rating at Underweight, with a target price of 82.0 dollars.

The Q2 financial report quarter was satisfactory. Revenue increased from 161.6B dollars in the same period a year earlier to 169.3B dollars, and earnings per share have not yet returned to stable levels, amounting to 0.67 dollars and exceeding the expected 0.64 dollars, less than 1.84 dollars last year.

Support and resistance

On the daily chart, the trading instrument continues to grow, holding above the resistance line of the ascending channel 76.00–69.00.

Technical indicators maintain a buy signal: the AO histogram stays high in the buy zone, and the fast EMA on the Alligator indicator is above the signal line, maintaining a wide fluctuation range.

Resistance levels: 77.80, 83.30.

Support levels: 76.10, 72.40.

Trading tips

Long positions may be opened after the price rises and consolidates above 77.80, with the target at 83.30 and stop loss 75.00. Implementation period: 7 days or more.

Short positions may be opened after the price falls and consolidates below 76.10, with the target at 72.40. Stop loss is 78.00.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()