| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 0.6035 |

| Take Profit | 0.5950 |

| Stop Loss | 0.6100 |

| Key Levels | 0.5950, 0.6040, 0.6090, 0.6200 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 0.6095 |

| Take Profit | 0.6200 |

| Stop Loss | 0.6050 |

| Key Levels | 0.5950, 0.6040, 0.6090, 0.6200 |

Current trend

The NZD/USD pair is correcting near 0.6060 amid the strengthening of the American currency and positive statistics from New Zealand.

Thus, the Q3 consumer price index rose by 0.6%, and the largest contribution to the dynamics of the indicator was made by tariffs for rates and payments of local authorities, which increased by 12.2%, the highest since 1990, as well as an increase in the price of tomatoes by 8.4%. Inflation decreased from 3.3% to 2.2% YoY, returning to the regulator’s target range of 1.0–3.0% for the first time since March 2021. The cost of rent ( 4.5%) and tobacco products ( 10.0%) increased the most. With consumer price dynamics slowing, officials at the Reserve Bank of New Zealand (RBNZ) may switch to “dovish” rhetoric, easing pressure on the economy.

The American dollar is holding at 103.40 in the USDX after the publication of positive macroeconomic statistics. Initial jobless claims decreased from 260.0K to 241.0K, leading to a change in the total claims from 1.858M to 1.867M. The September core retail sales index corrected from 0.2% to 0.5%, and their volumes – from 0.1% to 0.4%.

Support and resistance

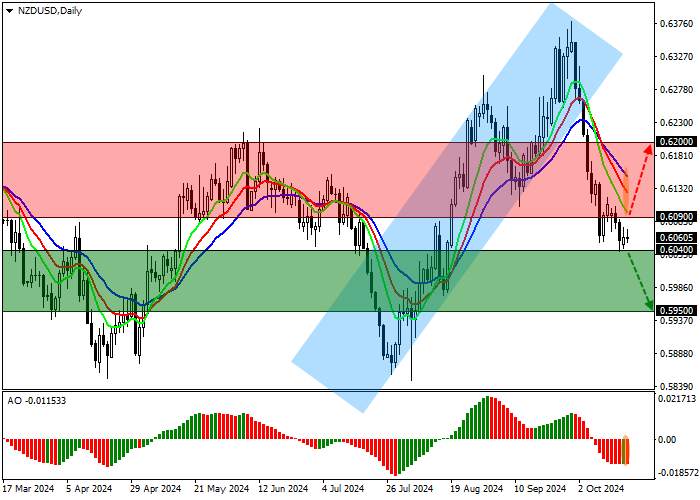

The trading instrument is correcting, retreating from the support line of the ascending channel 0.6280–0.6200.

Technical indicators reinforce the downward signal: fast EMA on the Alligator indicator moves away from the signal line, and the AO histogram forms downward bars below the transition level.

Resistance levels: 0.6090, 0.6200.

Support levels: 0.6040, 0.5950.

Trading tips

Short positions may be opened after the price declines and consolidates below 0.6040, with the target at 0.5950. Stop loss is 0.6100. Implementation period: 7 days or more.

Long positions may be opened after the price grows and consolidates above 0.6090, with the target at 0.6200. Stop loss is 0.6050.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()