| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendations | BUY STOP |

| Entry point | 100200.00 |

| Take Profit | 106250.00, 112500.00 |

| Stop Loss | 95000.00 |

| Key levels | 68750.00, 75000.00, 87500.00, 100000.00, 106250.00, 112500.00 |

| Alternative scenario | |

|---|---|

| Recommendations | BUY LIMIT |

| Entry point | 87500.00 |

| Take Profit | 106250.00, 112500.00 |

| Stop Loss | 83000.00 |

| Key levels | 68750.00, 75000.00, 87500.00, 100000.00, 106250.00, 112500.00 |

Current dynamics

Last week, the BTC/USD pair actively increased in value, continuing the rally that began after the re-election of Donald Trump as US President, and again reached historical highs, rising above the 99600.00 mark: prices are supported by confirmation of the imminent change of the chairman of the Securities and Exchange Commission (SEC), as well as investors' hopes for the transfer of the world's first cryptocurrency to the status of an American reserve asset.

Recall that at the end of last week, SEC Chairman Gary Gensler confirmed that he would resign on January 20, the day the Republican administration returned to the White House. Experts believe that he could be replaced by Mark Ueda, a member of the regulator's board who is much more loyal to digital assets. The likelihood of a quick transfer of Bitcoin to the US government reserve has led to a change in investor sentiment: they believe that the approval of the bill proposed by Wyoming Senator Cynthia Lummis back in July, which implies the government's purchase of 1.0 million BTC to store them for at least 20 years, will cause other developed countries to adopt similar measures. In this case, competition in the cryptocurrency market will increase significantly, becoming a driver of the upward dynamics of quotes.

All these factors contribute to the increase in investor interest in cryptocurrencies, which is confirmed by the growth of investments in Bitcoin ETFs, which amounted to $3.3531 billion last week, and the increase in the volume of stablecoins on cryptocurrency platforms: over the past 30 days it amounted to $9.7 billion, and over the weekend Tether issued additional USDT in the amount of another $3.0 billion. Thus, the fundamental background still contributes to the continued growth of BTC/USD in the medium term.

Support and resistance levels

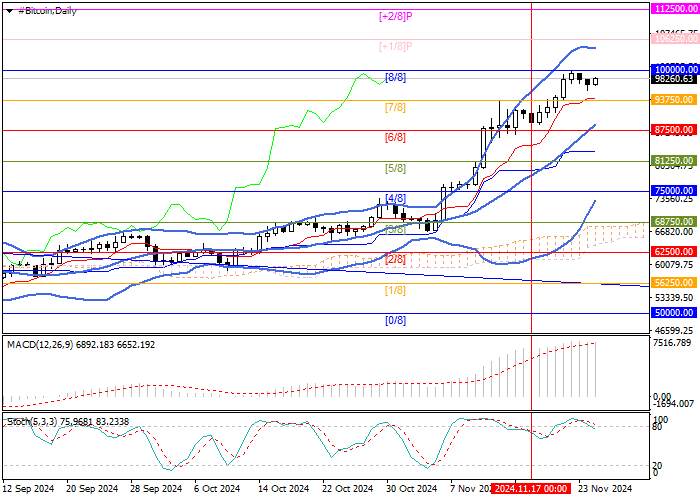

Technically, the asset is close to the resistance level of 100000.00 (Murray level [8/8]), consolidation above which will allow quotes to continue growing to 106250.00 (Murray level [ 1/8]) and 112500.00 (Murray level [ 2/8]). The key level for the bears seems to be 87500.00 (Murray level [6/8]), supported by the middle line of Bollinger Bands, a breakout of which downwards will open the opportunity to resume the downward dynamics to the targets of 75000.00 (Murray level [4/8]) and 68750.00 (Murray level [3/8]), but for now this scenario seems less likely.

Technical indicators point to the continuation of the upward trend: Bollinger bands are directed upwards, MACD is stable in the positive zone, while Stochastic is preparing to exit the overbought zone, which does not exclude a corrective decline, but its potential seems limited.

Resistance levels: 100000.00, 106250.00, 112500.00.

Support levels: 87500.00, 75000.00, 68750.00.

Trading scenarios

Long positions can be opened above the 100000.00 mark or when the price reverses in the 87500.00 area with targets at 106250.00, 112500.00 and stop losses at 95000.00 and 83000.00, respectively. Implementation period: 5-7 days.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()