| Scenario | |

|---|---|

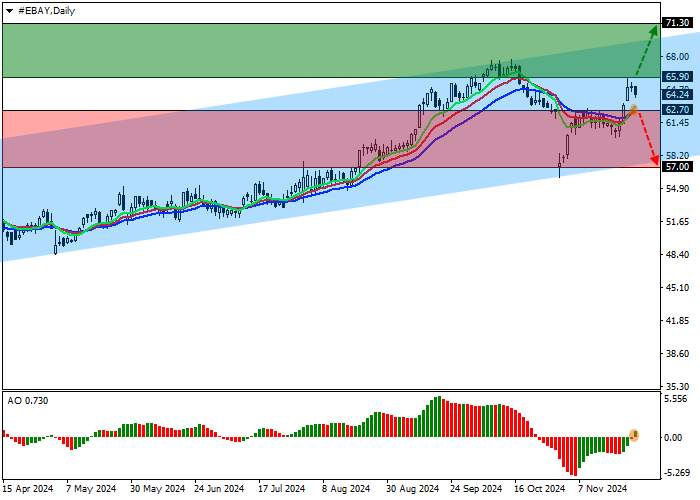

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 65.95 |

| Take Profit | 71.30 |

| Stop Loss | 63.00 |

| Key Levels | 57.00, 62.70, 65.90, 71.30 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 62.65 |

| Take Profit | 57.00 |

| Stop Loss | 65.00 |

| Key Levels | 57.00, 62.70, 65.90, 71.30 |

Current trend

Shares of eBay Inc., an American online retailing company, are adjusting at 64.00.

Experts from Truist Securities Inc. confirmed the rating of the emitter's shares at the "Hold" level, increasing the target price from 58.0 dollars to 62.0 dollars. The reason for this decision was the company's financial report published on October 30, which showed an excess of consensus estimates for earnings per share (EPS) and free cash flow (FCF). Analysts also noted the positive impact of the new share repurchase program in the amount of 750.0 million dollars, which is due to be implemented in the fourth quarter.

In addition, eBay Inc. expects that the gross merchandise value (GMV) will amount to 18.9–19.3 billion dollars for the fourth quarter and 74.2–74.6 billion dollars for the whole of 2024, and revenue – to 2.53–2.59 billion dollars and 10.23–10.29 billion dollars, respectively. At the same time, EPS could rise from 4.25 dollars in 2023 to 5.25 dollars in 2025.

On December 13, dividends of 0.27 dollars per share will be paid, which is equivalent to a quarterly yield of 1.68%. In 2025, it is expected to index to 0.29–0.30 dollars per paper.

Support and resistance

On the daily chart, the asset is adjusting, moving further away from the support line of the ascending channel with the boundaries of 70.00–57.00.

The technical indicators reversed around again and issued a new buy signal: the range of EMAs fluctuations on the Alligator indicator began to expand, fast EMAs are now above the signal line, and the AO histogram forms new correction bars, being slightly above the transition level.

Support levels: 62.70, 57.00.

Resistance levels: 65.90, 71.30.

Trading tips

If the asset continues to grow and the price consolidates above the maximum of 65.90, one may open long positions with a target of 71.30 and a stop-loss of 63.00. Implementation period: 7 days and more.

In the event of a reversal and continued decline of the asset, as well as price consolidation below the support level of 62.70, one can open short positions with a target of 57.00 and a stop-loss of 65.00.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()