| scenario | |

|---|---|

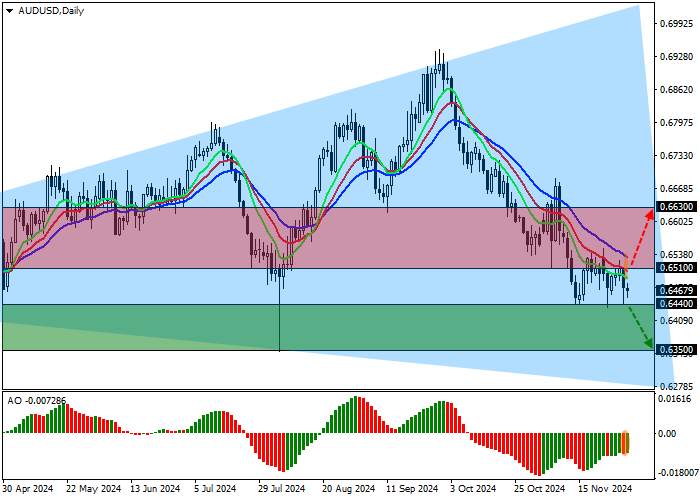

| chart | Weekly |

| Recommendation | SELL STOP |

| entry point | 0.6440 |

| Take Profit | 0.6350 |

| Stop Loss | 0.6500 |

| main levels | 0.6350, 0.6440, 0.6510, 0.6630 |

| alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| entry point | 0.6510 |

| Take Profit | 0.6630 |

| Stop Loss | 0.6470 |

| main levels | 0.6350, 0.6440, 0.6510, 0.6630 |

The ongoing trend

The AUD/USD currency pair is correcting in a sideways trend at 0.6467 thanks to the positive dynamics of the Australian dollar, supported by recent macroeconomic statistics. However, they are not good enough to ensure stable growth of the quotes.

According to the Australian Bureau of Statistics (ABS) report, retail sales increased by 0.6% in October, marking the third consecutive increase in the indicator ( 0.7% in August and 0.1% in September). Specifically, volume growth was recorded in the general merchandise ( 1.6%) and household goods ( 1.4%) categories, while declines were recorded in clothing, footwear and personal effects (-0.6%) and department stores (-0.3%). In addition, in October, the total number of building permits was adjusted by 4.2% to 15.498 thousand and the housing starts index was adjusted by 3.2% to AUD 8.33 billion. TD Securities inflation data for November reflected a decline in the index from 3.0% y/y to 2.9% y/y and from 0.3% m/m to 0.2% m/m, respectively. A further slowdown in the consumer price index could indicate an easing of monetary policy by the Reserve Bank of Australia (RBA), which has so far taken a neutral stance.

The US dollar is trading at 106.50 points on the USDX, supported by economic data for November, with the manufacturing index rising to 49.7 points from 48.5 points and the same measure from the Institute for Supply Management (ISM) rising to 48.4 points from 46.5 points. The industrial price index fell to 50.3 points from 54.8 points.

support and resistance

In the daily chart, the trading instrument corrects above the support line of the "Expanded Formation" with dynamic boundaries at 0.7000-0.6300.

The technical indicators are strengthening their sell signal: the fast EMAs of the Alligator indicator are pointing downwards and are keeping a stable distance from the signal line; the AO histogram is in the negative zone.

Supports: 0.6440, 0.6350.

Resistances: 0.6510, 0.6630.

trading tips

Short positions are relevant in case of downward movement with price consolidation below 0.6440 with price target of 0.6350 and stop loss at 0.6500. Validity: 7 days or more.

Long positions are intact in case of upside movement with price consolidation above 0.6510 with price target of 0.6630 and stop loss at 0.6470.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()