Oi prices steadied on Friday, on course for a weekly loss. The Fed and the ECB both signalled caution over further easing of monetary policy earlier this week, fanning more concerns about global economy.

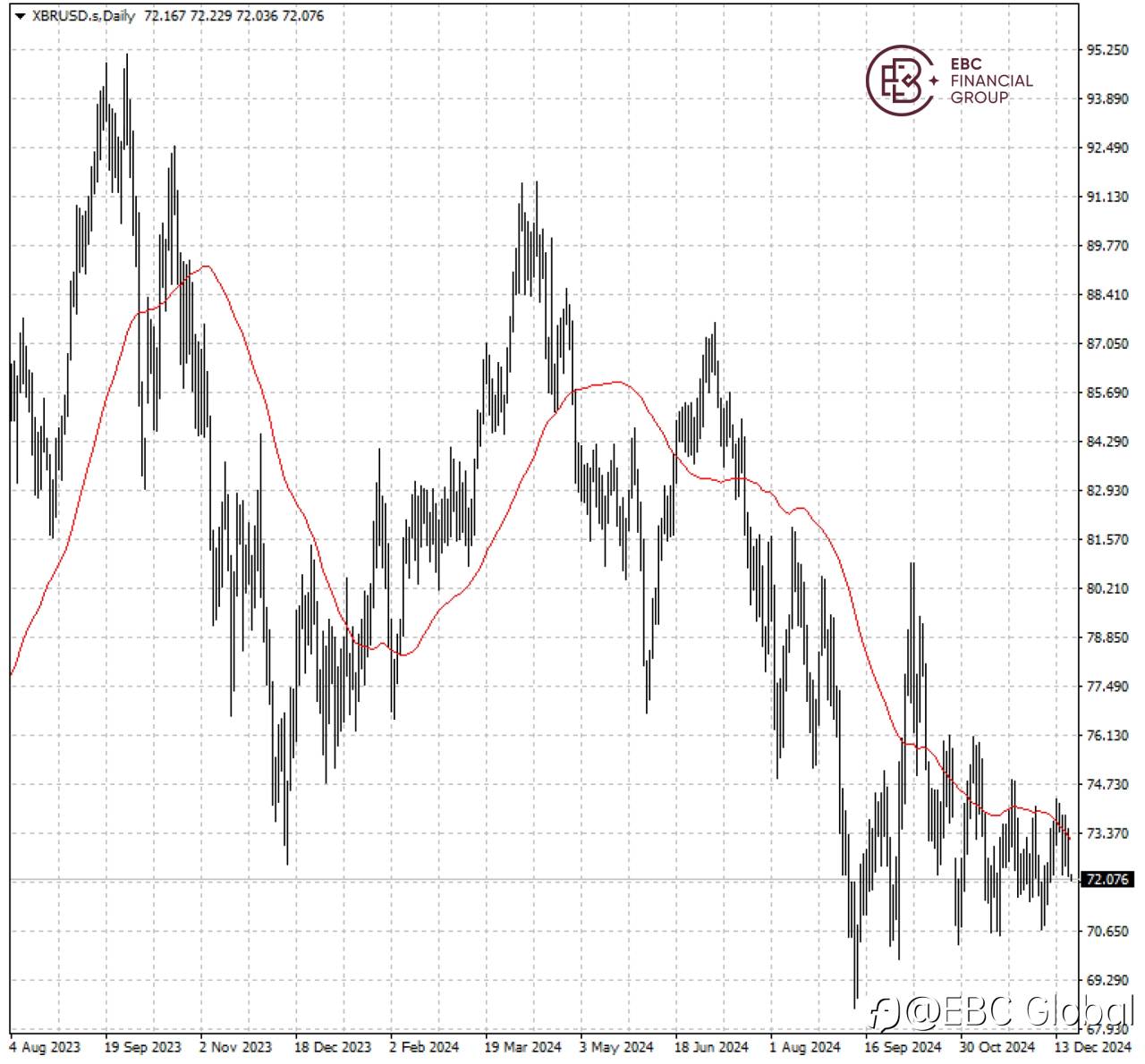

Softening economic activity could deepen a slowdown in oil demand growth next year. Brent futures prices have shed more than 5% so far this year, setting up a second consecutive annual loss.

China's energy sector faces fresh uncertainty in 2025 with Trump victory raising the prospect of another trade war and potential disruption to Iranian oil exports, said the Sinopec Economics and Development Research Institute.

The state firm also said it expects China's petroleum consumption to peak in 2027 as fuel demand weakens, partly due to the shift towards electric vehicles and the rise of trucks fuelled by LNG.

The oil market is widely expected to be in a surplus next year based on assumption of supply increase and slowing demand. Brent crude prices are forecast to average around $73 a barrel in 2025, according to a Reuters poll.

US crude stocks fell for a fourth straight week in the week ending 13 Dec, the EIA said. But the decline of 934,000 barrels was smaller than analyst forecast of a 1.6 million-barrel drawdown.

Brent crude fell below 50 SMA again and the range breakout we had awaited was yet to come. The falling wedge pattern indicates that a push above the resistance of $74 is on the cards.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()