European shares ended flat on Monday as caution prevailed, even as hopes grew that Trump could opt for a softer approach with his tariff policies in the coming weeks.

Nearly half of the strategists in a monthly Bloomberg survey have raised their forecasts for the market with less than a third of respondents expecting a pullback for the rest of the year.

The region is benefiting from several factors. German lawmakers passed a landmark spending package last week, unlocking hundreds of billions of euros for defence and infrastructure.

Besides markets expect two more interest-rate cuts from the ECB this year, taking interest rate to 2%. That will keep a wide gap with the Fed, favouring borrowers in Europe and drawing money into stocks.

A net 39% of respondents were overweight European equities relative to global markets, up from 12% last month and the biggest overweight position since mid-2021, according to the latest BofA fund manager survey.

A meeting between Russian and US officials on a partial ceasefire in Ukraine ended after 12 hours of negotiations in Saudi Arabia, Russian state media reported, with a joint statement expected later today.

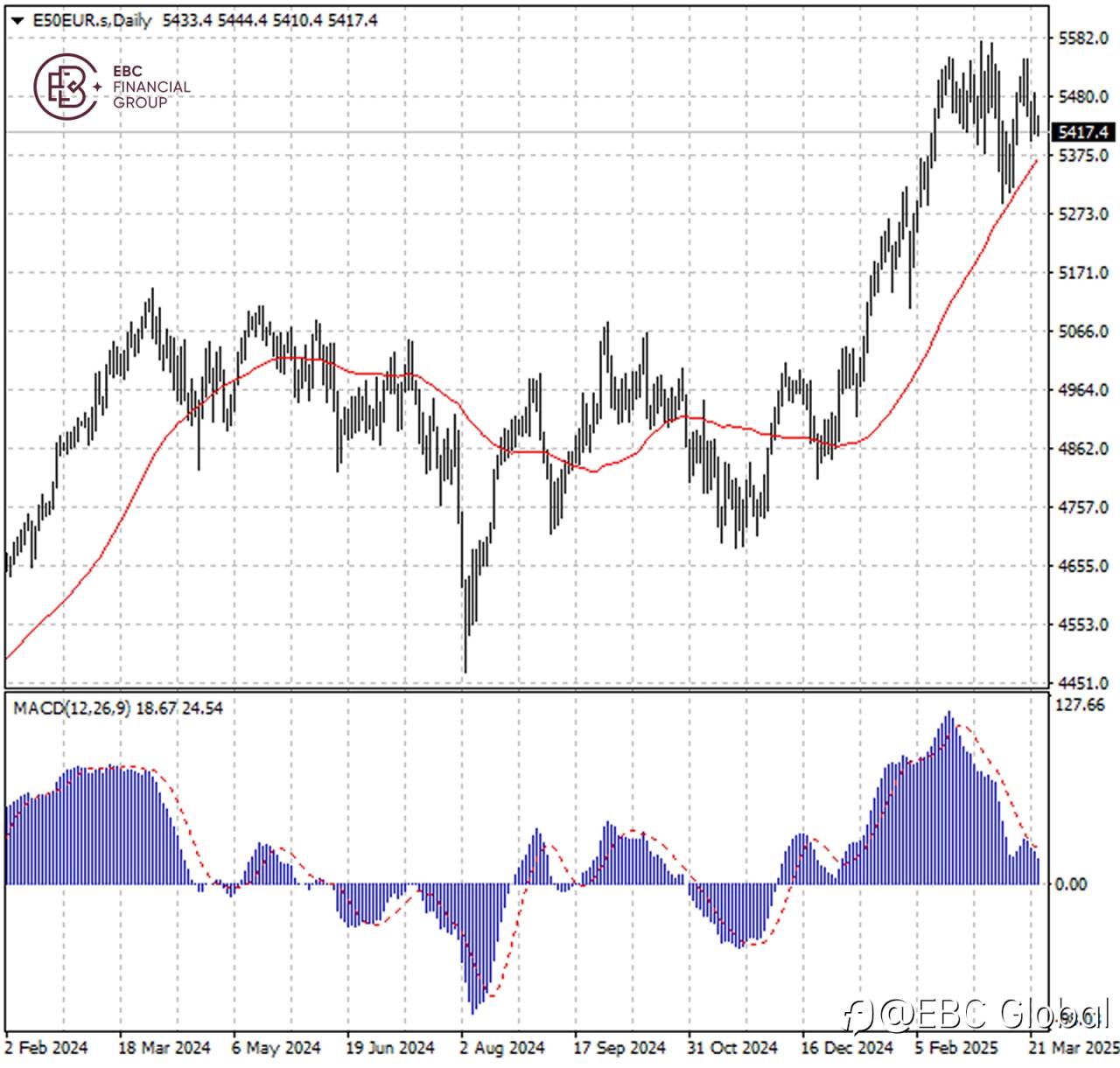

The Stoxx 50 remains supported by 50 SMA, but MACD divergence suggests the upside momentum has eased. As such the index could dip below 5,400 in the following sessions.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()