For many beginner investors in Taiwan, hearing the term “CFD” (Contract for Difference) often feels confusing. What exactly is it? Why does it frequently appear in forex, gold, stocks, and even cryptocurrency markets? Have you ever wondered how to profit from market fluctuations without owning the actual asset? Or perhaps you’re concerned about the high risks and whether they could lead to significant losses? Don’t worry—this article will break down CFD trading from the ground up, explaining its mechanics, advantages, and risks, and guiding you on how to get started quickly to become a successful investor.

1. What is CFD? A Simple Explanation

CFD stands for Contract for Difference, a type of financial derivative that allows investors to profit from asset price movements without actually owning the underlying asset. In simple terms, you enter into a contract with a broker, and your profit or loss is determined by the difference between the opening and closing prices of the asset.

For example: Suppose you predict that TSMC’s stock price will rise, and its current price is TWD 700. Using CFD with a 1:10 leverage ratio, you buy a contract worth TWD 100,000 but only need to deposit TWD 10,000 as margin. If the stock price rises to TWD 750, you close your position and earn a profit from the price difference: (750 - 700) × number of shares, all without actually purchasing TSMC stock. This flexibility is what makes CFD trading so attractive.

2. How CFDs Work: A Visual Breakdown

The key features of CFD trading are leverage and bidirectional trading (long and short positions). Here’s how it works:

- Choose an asset: This can be forex (e.g., EUR/USD), commodities (e.g., gold), stocks (e.g., Apple), indices (e.g., S&P 500), or even Bitcoin.

- Decide the direction: If you expect the price to rise, you go long (buy); if you expect it to fall, you go short (sell). For example, at the beginning of 2025, due to expectations of US interest rate cuts, the US dollar weakened—so you could short USD/JPY.

- Deposit margin: Leverage allows you to control a larger position with a small amount of capital. However, if the margin is insufficient, your position may be forcibly closed (margin call).

- Settle the price difference: Once the price moves, whether you make a profit or loss, the difference is directly reflected in your account balance.

This trading model makes CFDs popular among short-term traders, but because leverage amplifies both gains and losses, caution is necessary when managing risk.

The Four Major Advantages of CFDs: Why Are They Worth Trying?

1. High Flexibility

Unlike traditional stock trading, where you need to pay the full amount upfront, CFDs allow you to participate in the market with a smaller capital requirement through leverage. For example, in Q1 2025, gold surged past $2,600 per ounce due to geopolitical tensions. With just a few hundred dollars, you could trade a CFD position worth tens of thousands of dollars in gold.

2. Profit Opportunities in Both Directions

Regardless of whether the market is rising or falling, you can profit in either direction. For instance, when Bitcoin fell from $70,000 to $65,000 at the end of 2024, investors who shorted Bitcoin CFDs were able to make profits, just like those who profited from an uptrend.

3. Wide Range of Assets

From Taiwanese stocks to US equities, forex, and commodities, CFDs cover nearly all major financial markets. This means you can diversify your portfolio without opening multiple accounts across different exchanges.

4. Low Trading Costs

CFDs eliminate physical settlement fees, and the primary cost comes from the spread (the difference between the bid and ask price). Compared to the storage fees associated with holding physical gold, CFD trading offers a more cost-effective solution.

4. The Risks of CFDs: Three Common Pitfalls for Beginners

1. Leverage Magnifies Losses

While high leverage can amplify profits, it also amplifies losses. If the market moves against your position, your margin could be wiped out quickly. For example, with 1:100 leverage, a 1% adverse price movement could completely wipe out your capital.

2. Market Volatility

At the beginning of 2025, geopolitical tensions in the Middle East led to extreme oil price fluctuations. CFD traders who failed to set stop-loss orders faced significant losses.

3. Broker Risks

Choosing an unreliable broker could expose you to issues such as slippage (trade execution at an unexpected price) or fund security concerns. Selecting a regulated broker is crucial to ensure the safety of your investments.

5. Getting Started with CFD Trading: Three Simple Steps

Step 1: Learn the Basics

Familiarize yourself with key terms such as "spread," "margin," and "stop-loss", and study the market trends of your target assets. For example, Taiwan’s stock index is heavily influenced by the semiconductor industry, making TSMC's earnings reports a key factor affecting price movements.

Step 2: Practice with a Demo Account

Most platforms offer demo accounts for risk-free practice. Using MetaTrader 4 (MT4), you can test trading strategies with virtual funds. For instance, simulate a gold CFD trade and observe how prices react when breaking past the $2,600 resistance level.

Step 3: Start Small with a Live Account

Begin with $100 and use low leverage (e.g., 1:10) to minimize risk. Set strict take-profit and stop-loss levels to avoid emotional trading and potential losses.

6. Choosing the Right Platform: How Ultima Markets Supports CFD Trading

In CFD trading, a platform’s stability and professionalism directly affect your trading experience. This is where Ultima Markets, a globally recognized broker, stands out for Taiwanese investors. Here’s why:

- Diverse CFD Products: Trade over 250 financial instruments, including forex, precious metals, energy, and stock indices, so you never miss a market opportunity.

- Low Trading Costs: Spreads start from 0.0 pips, and leverage goes up to 1:2000, making it ideal for beginners with small capital.

- Professional Trading Tools: Supports the MT4 platform, featuring built-in technical indicators and automated trading (EA) to help analyze the market with precision. For instance, use the RSI indicator in MT4 to identify overbought conditions in gold.

- Funds Security: Regulated by multiple authorities (e.g., FSA and ASIC), with client funds stored in segregated accounts for transparent and safe trading.

- Localized Support: Offers a Chinese interface and 24/5 customer service tailored for Taiwanese traders, ensuring no language or time zone barriers.

Real-World Example: Imagine you trade crude oil CFDs on Ultima Markets in Q1 2025, when oil prices jump from $80 to $85 per barrel due to supply shortages. With low spreads and high leverage, your $500 margin could yield a $200 profit, showcasing the efficiency and advantages of trading with Ultima Markets. For investors looking to explore CFD trading, Ultima Markets is a trusted choice.

If you can't wait to put your knowledge into practice, click here to register a real account with Ultima Markets now. For beginners, it is recommended to start with a free demo account to experience a risk-free trading environment. Once registered, you will gain access to a demo account where you can trade U.S. stocks, stock indices, gold, silver, and other precious metals, over 60 forex currency pairs, and various financial instruments including Bitcoin. The platform provides market insights and real-time trading strategies, helping you seize trading opportunities while learning and practicing fundamental analysis of stocks and financial reports.

A demo account is an ideal way to get started with stock investing, as it helps you:

- Familiarize yourself with the platform and understand market trends.

- Test trading strategies without taking on actual financial risk.

- Build confidence in a safe environment before transitioning to real trading.

Remember, in stock market investing, consistent learning and rational decision-making are more important than simply chasing high returns. Choosing the right platform and approach will help you gradually improve your trading skills and navigate the forex market more effectively.

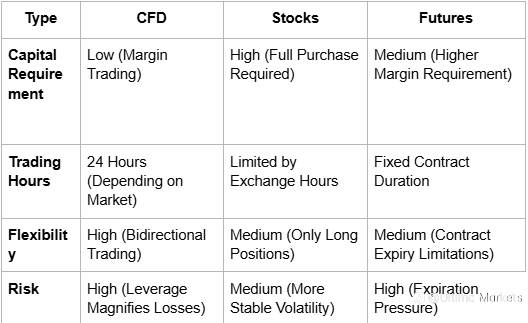

7. CFD vs. Other Investments: Which One Should You Choose?

For Taiwanese investors who prioritize flexibility, CFD trading is undoubtedly more attractive. However, for those who prefer long-term holdings, stocks or ETFs may be a better choice.

8. Conclusion: CFD—Making Investing Simpler and More Exciting

CFD is not an unattainable financial instrument but rather a powerful tool tailored for modern investors. It allows you to leverage a small amount of capital to participate in large markets, whether it’s capitalizing on gold’s safe-haven appeal or riding the wave of Taiwan’s booming tech stocks. Of course, high returns come with high risks. Choosing a professional platform like Ultima Markets, combined with scientific risk management strategies, will enable you to navigate the world of CFD trading with confidence. Start learning and practicing today, and unlock a new way to invest that suits you best!

FAQ: Popular Questions About CFD Trading

1. What is the difference between CFD and futures?

CFD trading does not have an expiration date, making it more flexible, whereas futures contracts have a fixed expiration period and require higher margin deposits. CFD is better suited for short-term trading, while futures are often used for hedging or long-term market predictions.

2. How much capital is required to start CFD trading?

The minimum deposit varies by platform, but some brokers allow you to start with as little as $50–$100. For example, Ultima Markets offers a low deposit requirement and high leverage options, making it an excellent choice for beginners.

3. How can I reduce the risks associated with CFD trading?

Setting stop-loss orders, avoiding excessive leverage, and diversifying investment assets are the three key strategies for managing CFD trading risks. For example, trading both gold CFDs and Taiwan stock index CFDs can help mitigate the impact of volatility in a single market.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()