China's A50 index has recouped all the losses following Trump's announcement of reciprocal tariffs. That came in contrast to its vulnerability during 2018 when local investors were rattled by a surge in US tariffs.

Many retail investors are helping defend the stock market - another battlefield in the broadening Sino-US conflict. The market has received 45 billion yuan in net retail inflows since 4 April, said Datayes.

State-backed institutional investors publicly vowed to buy more shares, top Chinese brokerages pledged to steady prices, and a slew of listed companies unveiled share buyback plans.

Q1 earnings season gets underway, but the impact of de-coupling on financial results will only begin to manifest itself the next quarter. The companies that rely heavily on exports are particularly disquieting.

The combined net profit of companies listed on the Shanghai and Shenzhen stock exchanges reached 3.383 trillion yuan for 2018, down 1.7% from the previous year.

The stakes are high for Southeast Asian nations caught in the crossfire. Vietnam's trade ministry has issued a directive to crack down on illegal transhipment of goods to trading partners, according to a Reuters report.

The country's goods imports are nearly 40% from China. New stricter procedures are to be implemented to inspect factories and supervise the release of "Made in Vietnam" labels.

Steeplechase

Volume is going down despite of the ongoing rally – a signal that the trend is losing steam and could reverse soon. Meanwhile, megacap bank stocks have lately hit their record highs, spurring caution.

Buying has been focused on sectors set to benefit from China's national agenda, such as defence, consumer and semiconductors. Patriotism is also promoting some professional investors to add exposures.

Concerns about American stock exchanges kicking Chinese firms out, resurfaced after Treasury Secretary Scott Bessent's recent comment that all options are "on the table" in trade talks with China.

US investors could be forced to offload around $800 billion of Chinese equities "in an extreme scenario" of financial decoupling between the world's two largest economies, Goldman Sachs estimates.

That includes about $250 billion worth of Chinese companies' ADR and $522 billion Hong Kong stocks. In the scenario, Chinese investors might need to unload $370 billion of US equities.

China kept benchmark lending rates steady on Monday for the sixth successive month as stronger-than-expected Q1 data might have reduced the urgency for immediate monetary easing.

The bank said it was encouraging SOEs to prioritise yuan usage in payment and settlement in their overseas expansion, in what is seen as an official attempt to accelerate yuan internationalisation.

Selective buying

Strategists at Goldman Sachs and Morgan Stanley recommended Asian consumer staples in reports released. Fidelity International said it snapped up battered Chinese consumer stocks.

The cohort is getting a boost from signs that Asian governments are ready to roll out fiscal stimulus to support spending. It's a sharp reversal in fortunes for the sector which had been overshadowed by AI boom.

Chinese authorities recently listed 48 measures to expand household spending. Fidelity favours mainland-listed shares to Hong Kong-traded ones, given the former may benefit more from Beijing's support measures.

However, a risk for consumer staples would be a flare-up in inflation, which can curb enthusiasm for the sector, said James Thom, senior investment director of Asian equities at Aberdeen Investments.

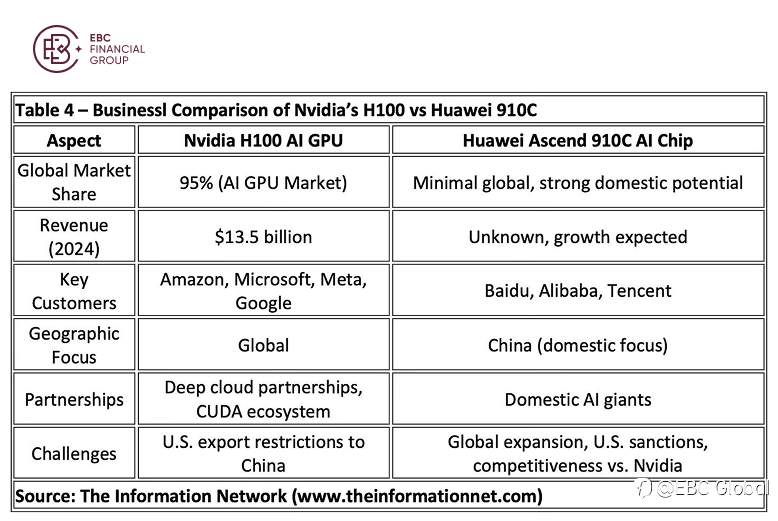

Huawei Technologies plans to begin mass shipments of its advanced 910C AI chip to Chinese customers as early as next month, two people familiar with the matter said, which could push tech stocks further higher.

David Barrett, CEO of EBC(UK) Ltd, said Chia's AI investment could help benefit consumption. The timing is fortuitous for Chinese AI companies which have been left scrambling for domestic alternatives to the H20.

A number of semiconductor experts have expressed doubt that the latest restrictions on Nvidia will achieve their intended purpose. Next month, the company may face additional restrictions under "AI diffusion rules."

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

风险提示:以上内容仅代表作者或嘉宾的观点,不代表 FOLLOWME 的任何观点及立场,且不代表 FOLLOWME 同意其说法或描述,也不构成任何投资建议。对于访问者根据 FOLLOWME 社区提供的信息所做出的一切行为,除非另有明确的书面承诺文件,否则本社区不承担任何形式的责任。

FOLLOWME 交易社区网址: www.followme.ceo

加载失败()