Donne

Morning briefing: Euro can head towards 1.1600-1.1800

The Dollar Index on a confirmed fall below 99 can open the doors for 98-96. The Euro on an immediate break past 1.14 can head towards 1.16-1.18. EURINR has immediate support near 94.50, above which it can bounce back towards 96.50. EURJPY and USDJPY are back within their old range of 164-160 and 145

What markets are getting wrong about the Bank of England

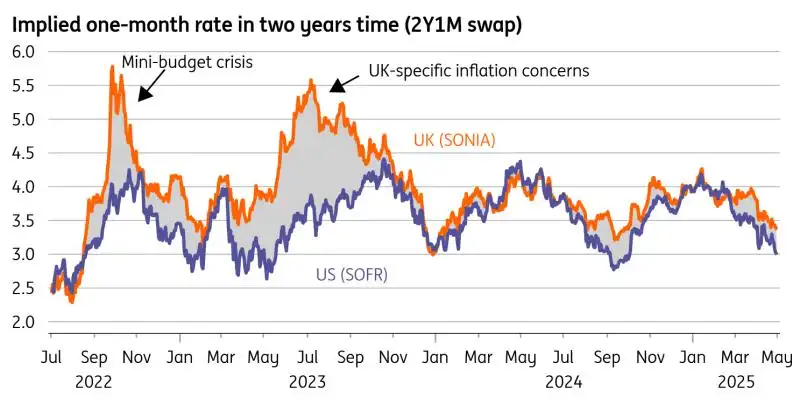

The Bank of England is poised to cut rates at its 8 May meeting, and markets are pricing a faster pace of easing thereafter. We're less convinced the Bank will deviate from its once-per-quarter cutting rhythm, but we do think it could cut rates to a lower level than investors are currently expecting

- Tony Finance :Good morning

- Tony Finance :My fiend

- Tony Finance :How are you today

EUR/USD: Watch price action – OCBC

Euro (EUR) drifted lower after rising to >3Y high of 1.1570 levels last week. De-escalation in tariff angst somewhat slowed USD’s decline and helped to moderate the pace of rally in EUR. EUR was last seen at 1.1390 levels, OCBC's FX analysts Frances Cheung and Christopher Wong note. 2-way trades

Everyone is a genius after the fact

S2N spotlight Let me walk you through the reality of investing. I am going to present the 10-year performance of the major world indices and the factors driving the US stock market. I could pick any two examples, but I think these ones are quite relatable. We start by looking at the cumulative perfo

Turnaround Tuesday, as Tesla blames Trump’s tariffs for poor performance

The big news on Tuesday was the rapid shift in sentiment during the US trading session. US stocks surged, led by the financials sector and consumer discretionary. The driver was once again tariffs, which is dominating market sentiment for another week. This time the news was risk-positive, Treasury

EUR consolidates rally from February lows – Scotiabank

The Euro (EUR) is softer, down 0.2% against the US Dollar (USD) and underperforming most of the G10 currencies along with Swiss Franc (CHF) and Australian Dollar (AUD), Scotiabank's Chief FX Strategist Shaun Osborne notes. ECB sees US tariffs as disinflationary "The EUR’s modest weakness is likely j

USD/INR remains weak as concerns over Fed’s independence rise

Indian Rupee strengthens in Tuesday’s Asian session. Positive trends in Indian equities and concerns over the Fed’s independence could boost the INR. Traders brace for the speeches from Fed’s Harker and Kashkari later on Tuesday. The Indian Rupee (INR) edges higher on Tuesday after hitting a four-mo

CAD firmer but underperforms G10 peers – Scotiabank

USD/CAD traded briefly on a 1.37 handle earlier for the first time since October, Scotiabank's Chief FX Strategist Shaun Osborne notes. Trend signals remain bearishly aligned "Broader USD weakness is helping lift the CAD tone but the CAD finds itself at the foot of the overnight performance table, w

Euro ignores the cut, Dollar ignores Powell — Welcome to the macro rotation trade

Market wrap Asian markets traded on a firmer note, with Japanese equities inching higher and the yen on the back foot after the first round of U.S.-Japan trade talks delivered what President Trump called “big progress.” The key market read? Japan may avoid steeper tariffs — and just as importantly,

EUR rises within range – Scotiabank

Euro (EUR) is up an impressive 0.7% against the US Dollar (USD) and recovering back toward the upper end of its four- session range, strengthening in tandem with its regional peers Swiss Franc (CHF) and Swedish Krona (SEK), Scotiabank's Chief FX Strategist Shaun Osborne notes. EUR rises on as-expect

上拉加载