昕辰esq

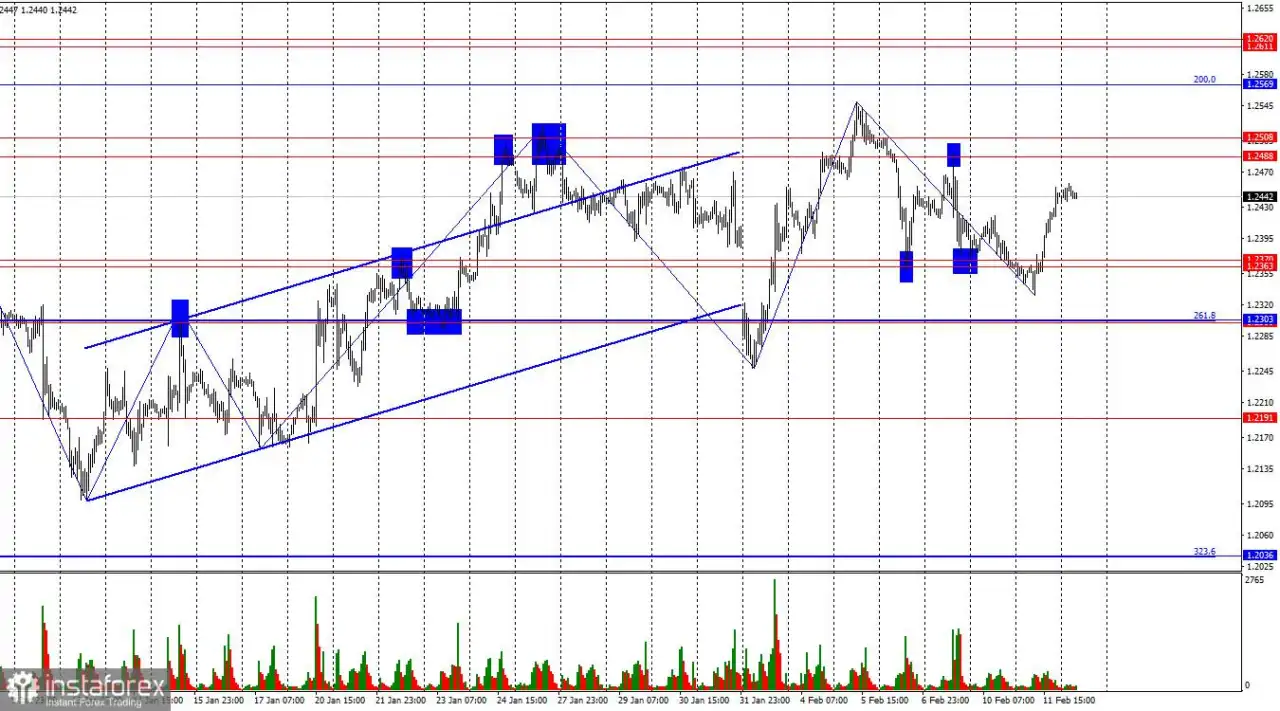

GBP/USD – 12 Februari: Semua Mata Tertuju pada Laporan Inflasi AS

Pada grafik per jam, GBP/USD berbalik menguntungkan pound di bawah zona support 1,2363 – 1,2370 dan memulai pergerakan naik baru menuju zona resistance 1,2488 – 1,2508. Sayangnya, tidak ada pantulan dari zona 1,2363 – 1,2370, yang seharusnya memberikan sinyal beli yang kuat. Para bull mungkin juga k

PayPal Holdings Inc.: wave analysis

ScenarioTimeframeWeeklyRecommendationBUYEntry Point87.00Take Profit95.50, 102.50Stop Loss84.15Key Levels57.10, 67.35, 76.67, 95.50, 102.50Alternative scenarioRecommendationSELL STOPEntry Point76.65Take Profit67.35, 57.10Stop Loss79.75Key Levels57.10, 67.35, 76.67, 95.50, 102.50Growth is possible. On

Melonjak 20%, Saham Reddit Milik Bos ChatGPT Bernilai Rp 18,88 T

Sam Altman. Foto: (Steve Jennings/Getty Images for TechCrunch) Jakarta CEO OpenAI, Sam Altman memiliki saham di perusahaan media sosial Reddit yang bernilai lebih dari US$ 1 miliar atau Rp 15,73 triliun (kurs Rp 15.735) pada perdagangan Selasa (29/10). Saham itu melonjak sekitar 20% setelah perusaha

ANG USD/INR AY MAS MATAAS KAYSA SA DATA NG US RETAIL SALES

Lumambot ang Indian Rupee sa Asian session noong Huwebes.Ang patuloy na pagbebenta ng mga domestic equities ng mga foreign portfolio investors ay tumitimbang sa INR.Ang US September Retail Sales ang magiging highlight sa Huwebes. Ang Indian Rupee (INR) ay nakikipagkalakalan na may banayad na pagkalu

GBP: An important week for the BoE story – ING

This week's release of UK jobs and especially inflation data on Wednesday could have a decent say in the pricing of the Bank of England's easing cycle and sterling, ING’s FX analyst Chris Turner notes. GBP/USD can press the 1.3000 area “UK rates have been dragged higher by those in the US

NZ Treasury: Don't expect activity to have picked up much in the latest quarter

The latest economic assessment from the New Zealand (NZ) Treasury showed on Tuesday that they “don't expect activity to have picked up much in the latest quarter.” Additional takeaways The June quarter GDP fell by 0.2%, less than expected, with population growth masking economic weakness. With a sig

非农数据将引爆市场!黄金涨跌一触即发!

行情分析: 1. ADP数据的前瞻性指引: ADP就业数据通常作为NFP的前瞻指引。如果今晚的非农数据与ADP报告方向一致且强劲(就业增长超预期),则可能增强市场对美联储继续加息的预期,推升美元,并压低金价。黄金作为非收益资产,在加息周期中通常会受到抑制。 2. 非农数据与美联储政策: 非农数据直接关系到美联储的货币政策。若今晚的NFP数据显示就业市场依然强劲,美联储将可能继续维持紧缩政策,抑制通胀,进一步加大加息预期。这种情况下,黄金短期内可能面临较大的下行压力。 反之,若非农数据弱于预期,显示出美国经济有放缓迹象,美联储可能采取更为谨慎的货币政策,甚至可能放缓加息步伐,这将对黄金构成支撑,

Terungkap Rencana MIND ID Mau IPO

Foto: Wakil Menteri Badan Usaha Milik Negara (BUMN) Kartika Wirjoatmodjo (Vadhia Lidyana/detikFinance) Jakarta Wakil Menteri BUMN Kartika Wirjoatmodjo memberi sinyal perusahaan BUMN yang akan melantai di bursa melalui pencatatan saham perdana atau initial public offering (IPO) ke depan. Pria yang ak

上拉加载