#Bank#

926 浏览

158 讨论

A bank is a financial institution that accepts deposits from the public and creates credit.

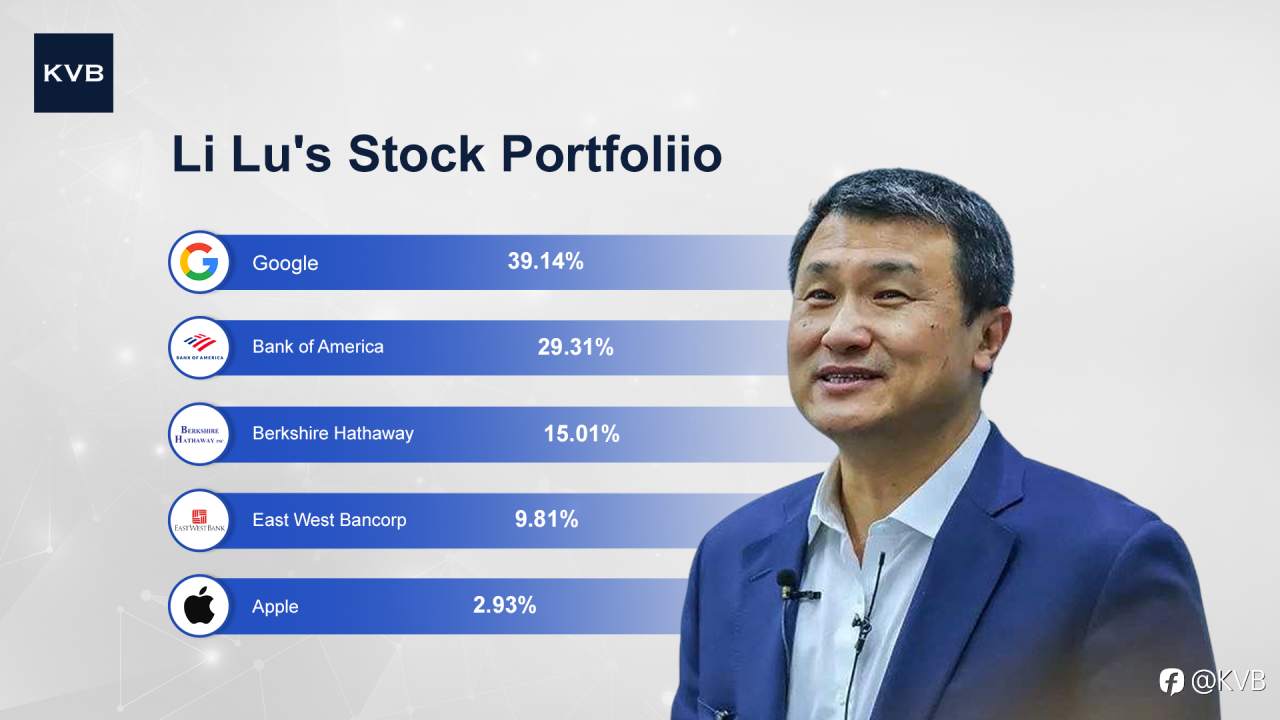

Here’s a sneak peek into Li Lu's Stock Portfolio ! 👀

Check out his top 5 picks 🔥: 1️⃣Google 39.14% 2️⃣Bank of America 29.31% 3️⃣Berkshire Hathaway 15.01% 4️⃣ East West Bancorp 9.81% 5️⃣ Apple 2.93% These game-changing companies are shaping the future. Would you follow Li Lu's in investing? 😎 👉Follow KVB for more conten

Here’s a sneak peek into Guy Spier's Stock Portfolio ! 👀

Check out his top 5 picks 🔥: 1️⃣American Express 21.5% 2️⃣Berkshire Hathaway 19.1% 3️⃣Ferrari 12.9% 4️⃣Mastercard Incorporated 12.4% 5️⃣Bank of America 11.9% These game-changing companies are shaping the future. Would you follow Guy Spier's in investing? 😎 👉Fol

KVB

🚨Australia CPI inflation slows to 3-year low of 2.7% 🇦🇺

Australia's consumer price inflation dropped to a three-year low in August, thanks to government electricity rebates and a decrease in petrol prices. The annual CPI rose by 2.7%, down from 3.5% in July, matching market expectations. Core inflation, measured by the trimmed mean, fell to 3.4% from 3.8

KVB

The Reserve Bank of Australia Minutes: Ready to provide yet more policy stimulus

The Reserve Bank of Australia's Minutes has sown that the central bank is ready to provide yet more policy stimulus if needed after cutting rates to record lows, a pledge that may be tested given the latest outbreak of coronavirus in the country.

''Minutes of the Reserve Bank of Australia's (RBA) No

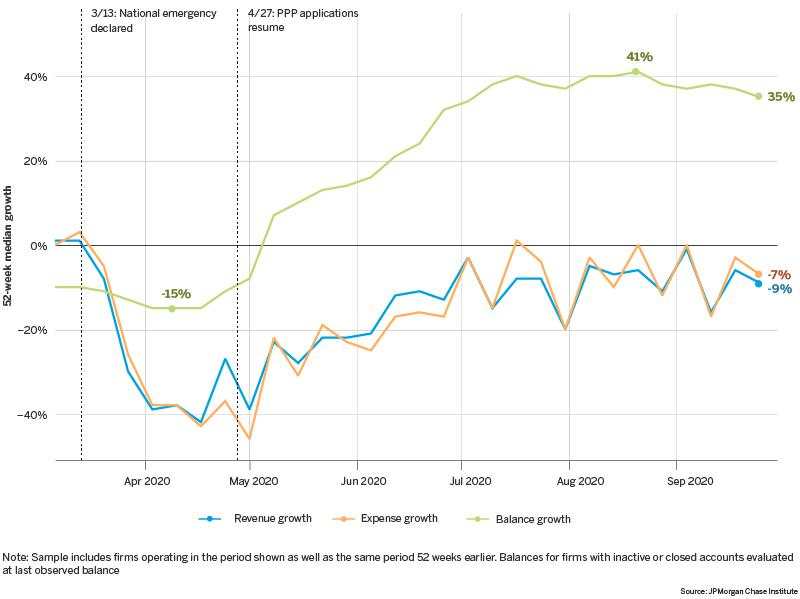

(JPMORGAN CHASE & CO.) Research: Small Business Expenses during COVID-19

November 2020 As the COVID-19 pandemic continues to affect the physical and economic health of the U.S., policymakers continue to have an incomplete view of the financial response of the small business sector. In the early months of the pandemic, the typical small business saw substantial revenue an

InteractiveCrypto Fast Becoming Traders Favourite Crypto News Platform

The site offers the latest crypto news, educational articles and guides, in-depth studies, expert opinions, information on trading and the best brokers for cryptocurrency trading, along with digital wallets. All the cryptocurrency information and news offered on the InteractiveCrypto platform is bas

INSIGHTS - Get Ready for Brexit: Top 5 Tips for Financial Institutions

Photo: Finance Magnates All passporting rights will be lost when the UK leaves the European single market on 31 December 2020, This could cause issues for: UK-authorised firms that currently passport their authorisations into Europe. EEA-authorised firms that currently passport their authorisations

🚨China cuts loan prime rate to boost slowing economy ⬇

The People’s Bank of China (PBOC) has unexpectedly cut its benchmark loan prime rates to record lows due to signs of a slowing economic recovery. The one-year loan prime rate was reduced to 3.35% from 3.45%, and the five-year LPR, which affects mortgage prices, was lowered to 3.85% from 3.95%. These

KVB

Asia's Largest Companies by Market Cap 2024 🌏🔝

TSMC is Asia's top company by market cap, hitting a massive $737 billion. As the world's biggest independent semiconductor maker, TSMC is a key player in the tech world, making chips for big names like Apple, AMD, and Nvidia. Their cutting-edge tech and innovation keep them ahead of the game, shapin

KVB

Australia September business confidence -4 (prior -8), conditions 0 (prior -6)

National Australia Bank business survey

Business conditions 0

-6 in August

the low for this was -34 in April

long-run average is +6

rise for all 3 submeasures in September, both trading and profitability into positive territory

employment sub-component still negative

Business confidence -4

🚨April US CPI inflation preview: 'The descent begins' 🚀

The Bank of America released a note on Thursday, suggesting that inflation will persist at uncomfortably high levels. Their analysts anticipate that April's core CPI inflation will moderate to 0.28% month-on-month (MoM), slightly lower than the first quarter's average of 0.37%. However, they believe

KVB

【ACY证券】美国又被下调评级,这次轮到了银行业!

继惠誉之后,又一大评级机构对美国市场出手了。昨日,全球最具影响力的三大评级机构之一的穆迪下调了美国10家中小型地区银行的信用评级,同时还将6家中大型银行的评级列入“下调观察名单”,其中不乏美联储定义的系统性重要银行。 穆迪给出的理由是银行存款持续流失,经济存在衰退风险,同时商业地产表现低迷。受此消息影响,美国银行板块从盘前市场便持续下跌,开盘后更是跳空下滑。不过看到开盘的跳空大跌后,穆迪也意识到不对,赶紧公开找补,称美国银行业仍然强大,没有系统性破裂。美国银行板块也随之收复了大部分跌幅。 针对这两大评级机构的“黑天鹅”式偷袭,很多交易员都摸不着头脑。明明美国政府的债务上限问题已经得到解决,同时

The scenario for the future of the market after the banking crisis.

Ba kịch bản cho tương lai của thị trường sau cuộc khủng hoảng ngân hàng Kịch bản đầu tiên, và lạc quan nhất, là những sự kiện này tỏ ra bị cô lập. Các vấn đề được kiểm soát, niềm tin trở lại thị trường và nền kinh tế vẫn kiên cường. Trong tình huống này, Fed sẽ tiếp tục kế hoạch ban đầu là giữ

Đồng đô la tăng giá với kì vọng rằng Fed sẽ tăng lãi suất sau báo cáo việc làm.

Đồng đô la tăng vào thứ Hai, được hỗ trợ bởi lợi suất trái phiếu kho bạc tăng khi thị trường đặt cược vào một đợt tăng lãi suất khác của Cục Dự trữ Liên bang. Lợi suất đã tăng vọt sau dữ liệu gần đây cho thấy thị trường lao động vẫn mạnh và hệ thống ngân hàng đã bớt căng thẳng. Dollar Index, đo lườn

上拉加载