#Inflation#

1.54k 浏览

299 讨论

Inflation is a quantitative measure of the rate at which the average price level of a basket of selected goods and services in an economy increases over some period of time. It is the rise in the general level of prices where a unit of currency effectively buys less than it did in prior periods.

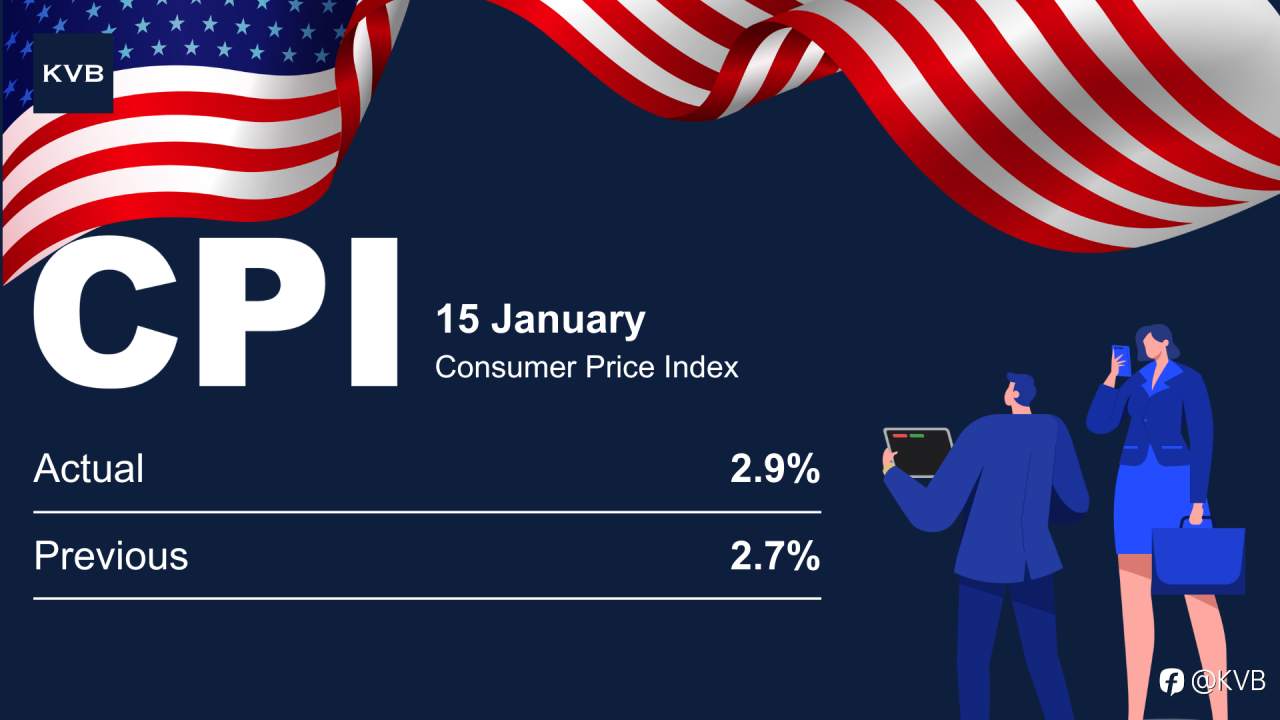

Inflation rate eases to 2.4% in March, lower than expected.

Inflation rate eases to 2.4% in March, lower than expected; core at 4-year low 🔴 Below Expectation: Headline inflation dropped to 2.4% in March, beating forecasts and down from 2.8% in February. 🔴 Core Inflation Falls: Core CPI rose just 0.1% MoM, holding at 2.8% YoY—the lowest since March 2021. �

KVB

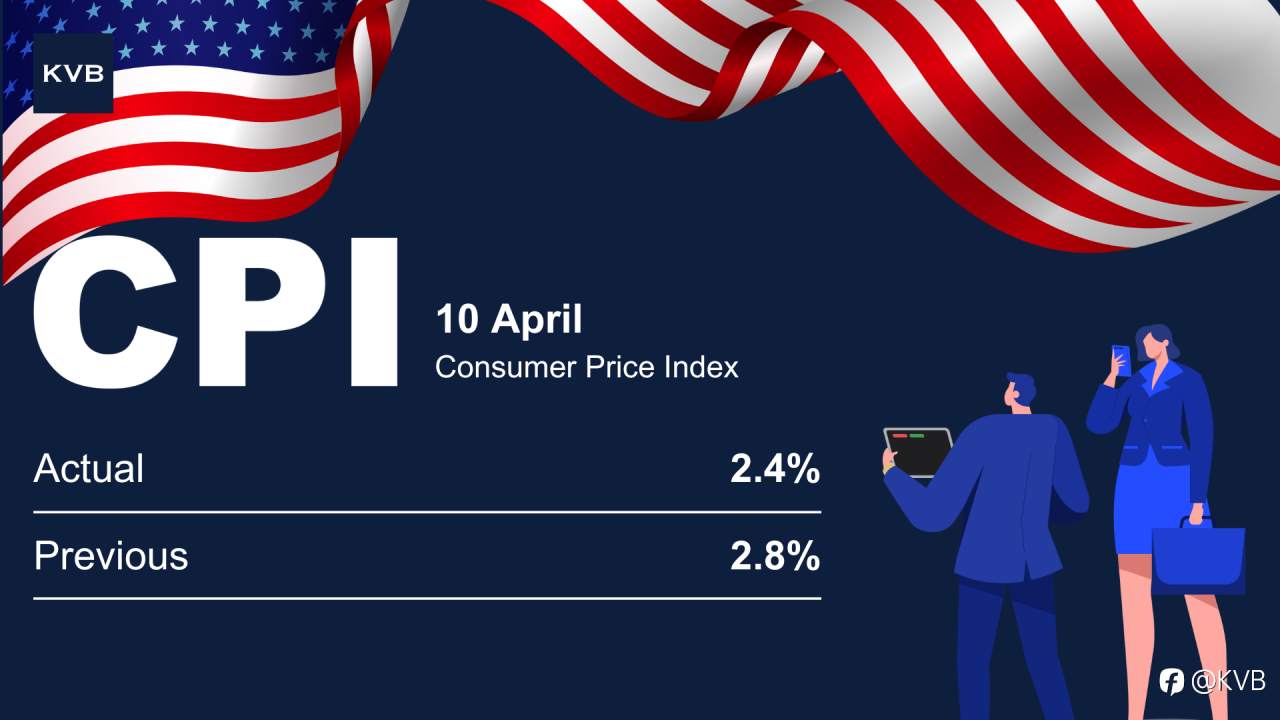

Inflation Eases to 2.8% – A Sign of Relief?

🔴 Below expectation: Headline inflation cooled to 2.8% in February, with core inflation at 3.1%, both 0.1% below forecasts. 🔴 Slower CPI Growth: Prices rose just 0.2% last month, slightly below projections. 🔴 Tariff Risks Remain: While easing inflation is a positive sign, concerns over tariff-dri

KVB

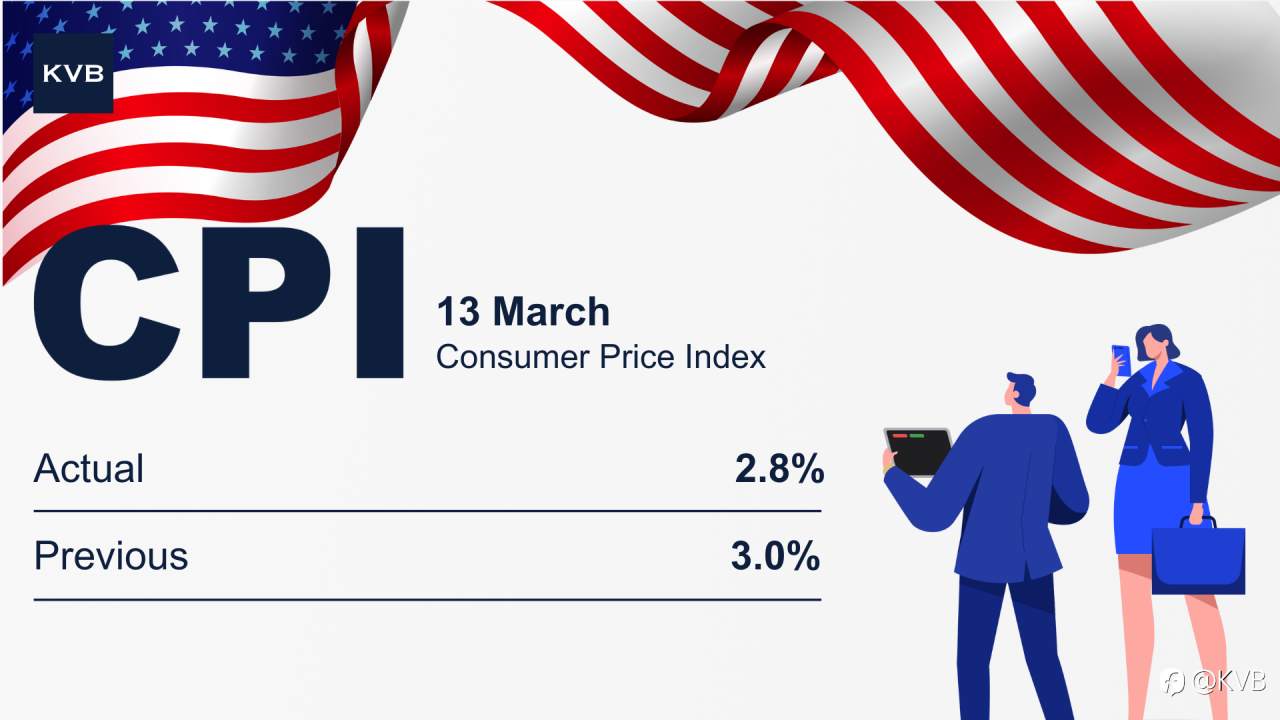

CPI Jumps 3.0% – What Does It Mean for Markets? 🧐

🔴 Inflation Heats Up: U.S. consumer prices rose 3.0% year-on-year in January, the biggest jump in nearly 1.5 years. Monthly increase: 0.5%, led by shelter, food, and gasoline. 🔴 Core Inflation Steady: Core CPI rose 0.4% in January and 3.3% year-on-year, showing persistent inflation. 🔴 Fed on Hold

KVB

ECB Cuts Rates Again – What’s Next for the Eurozone? 🇪🇺

🟢 Rate Cut: ECB drops interest rates from 3.40% to 3.15%, with the deposit rate now at 3.00%. 🟢 Reason: The eurozone economy struggles with weak growth, political drama, and global trade jitters. 🟢 Market outlook: More rate cuts might be coming soon, as inflation is expected to settle at 2% by ea

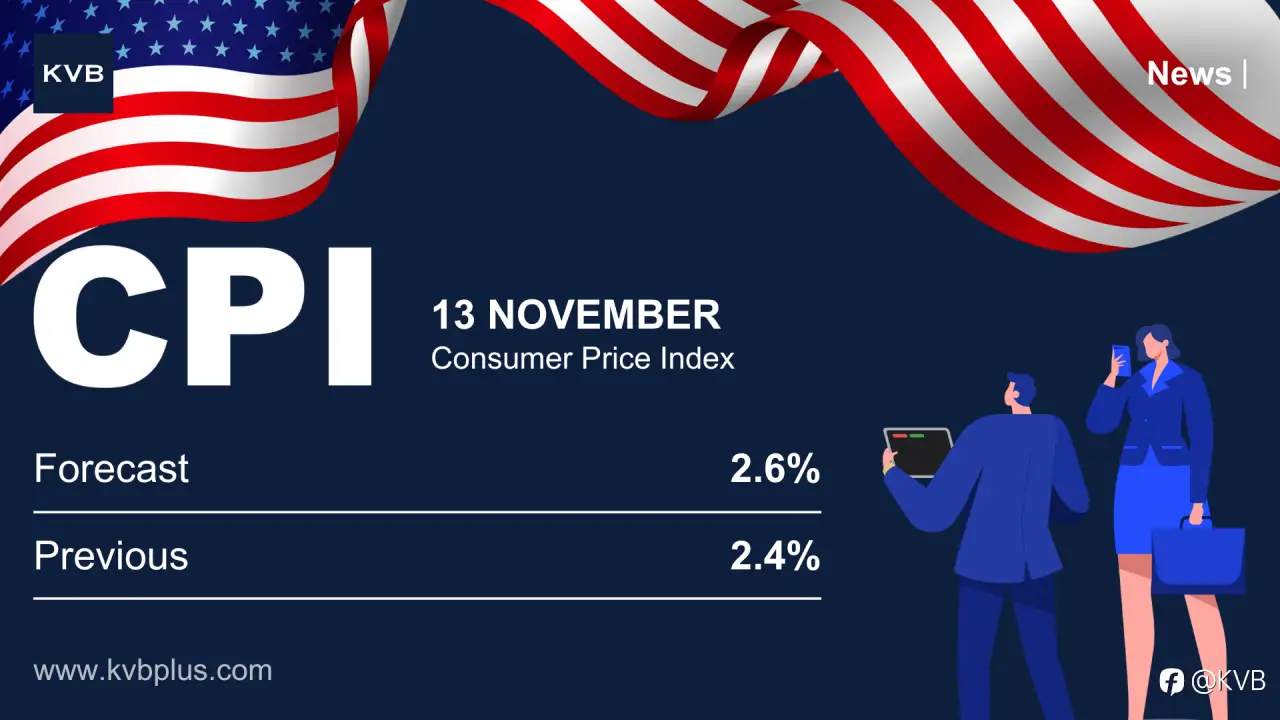

📈 Market analysis: Australian Dollar Faces Downward Pressure as US Dollar Holds Strong

The Aussie Dollar (AUD) is struggling against the US Dollar (USD) ahead of the US CPI data release, expected to show a slight inflation rise. A strong inflation print could boost the USD, reducing the chances of a Fed rate cut. The RBA also kept rates unchanged at 4.35%, adding pressure to the AUD.

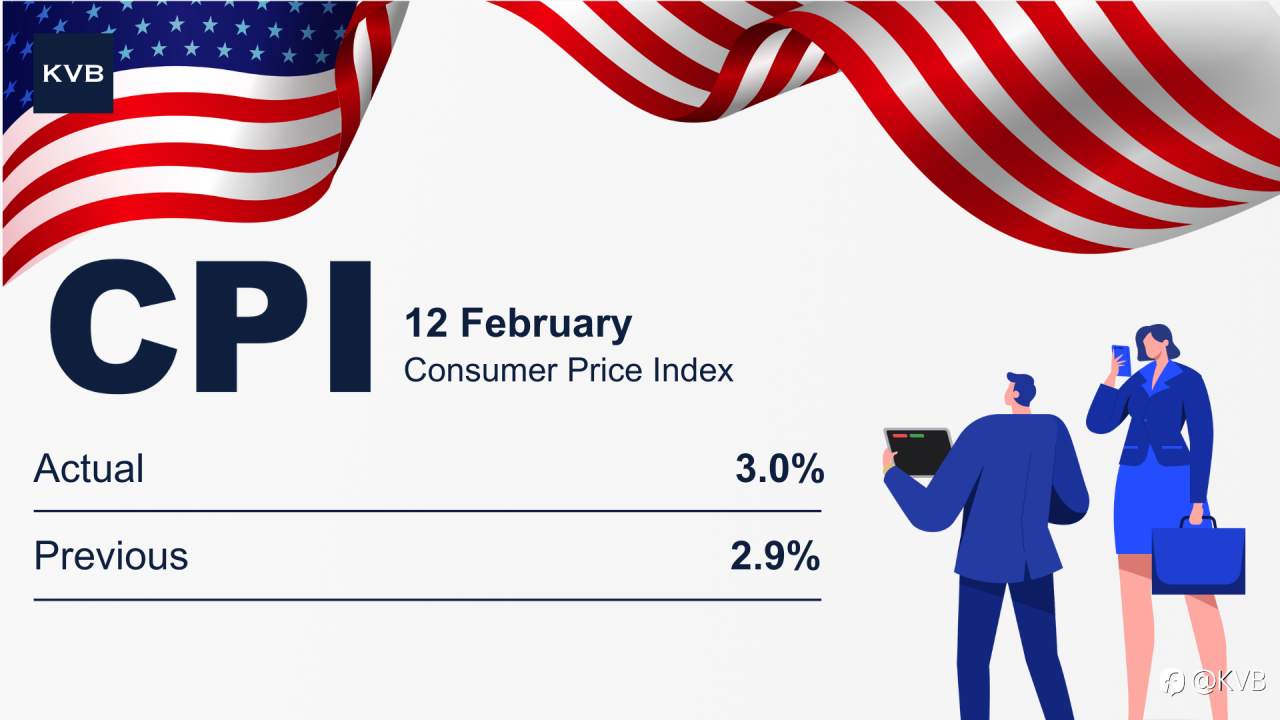

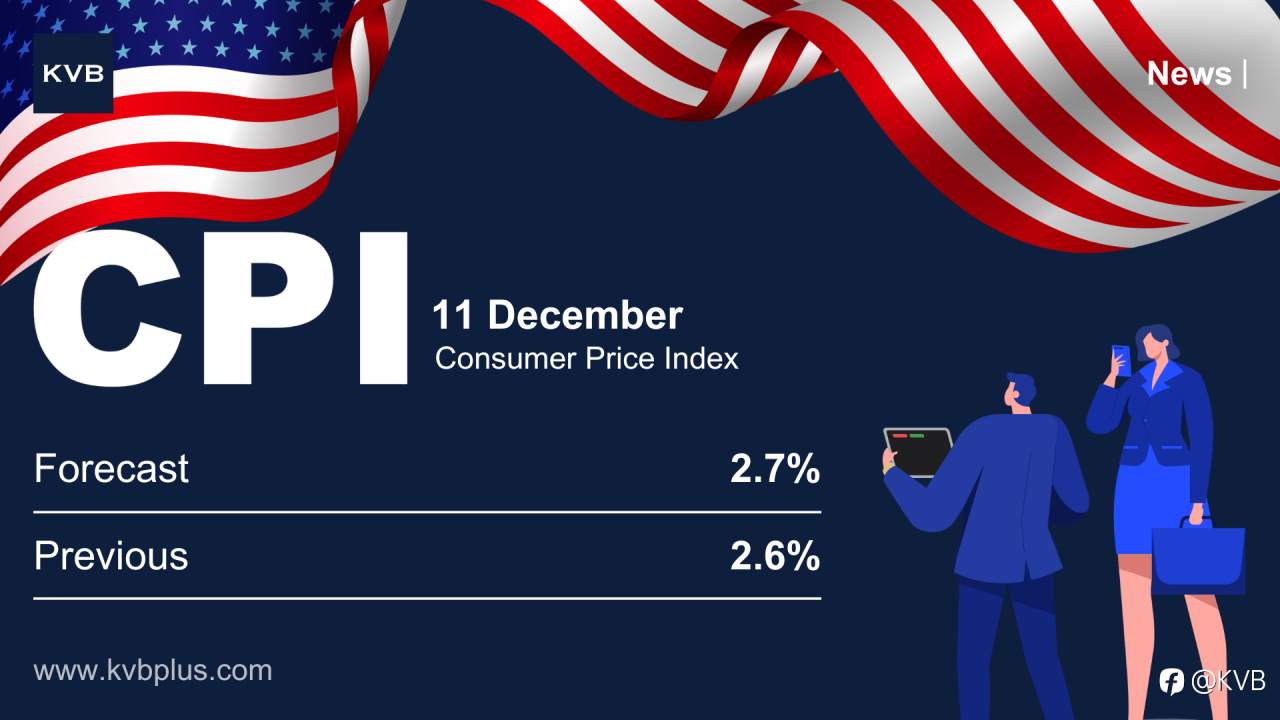

Inflation Hits 2.7% – What Does It Mean for You? 🤔

🟢 Annual Increase: CPI climbed to 2.7% year-over-year in the latest report, up from 2.6%, with a 0.3% monthly rise. 🟢 Core Inflation Steady: Excluding food and energy, core CPI stood at 3.3% annually and 0.3% monthly, perfectly aligned with expectations. 🟢 Market Reaction: Traders now see a 99% c

KVB

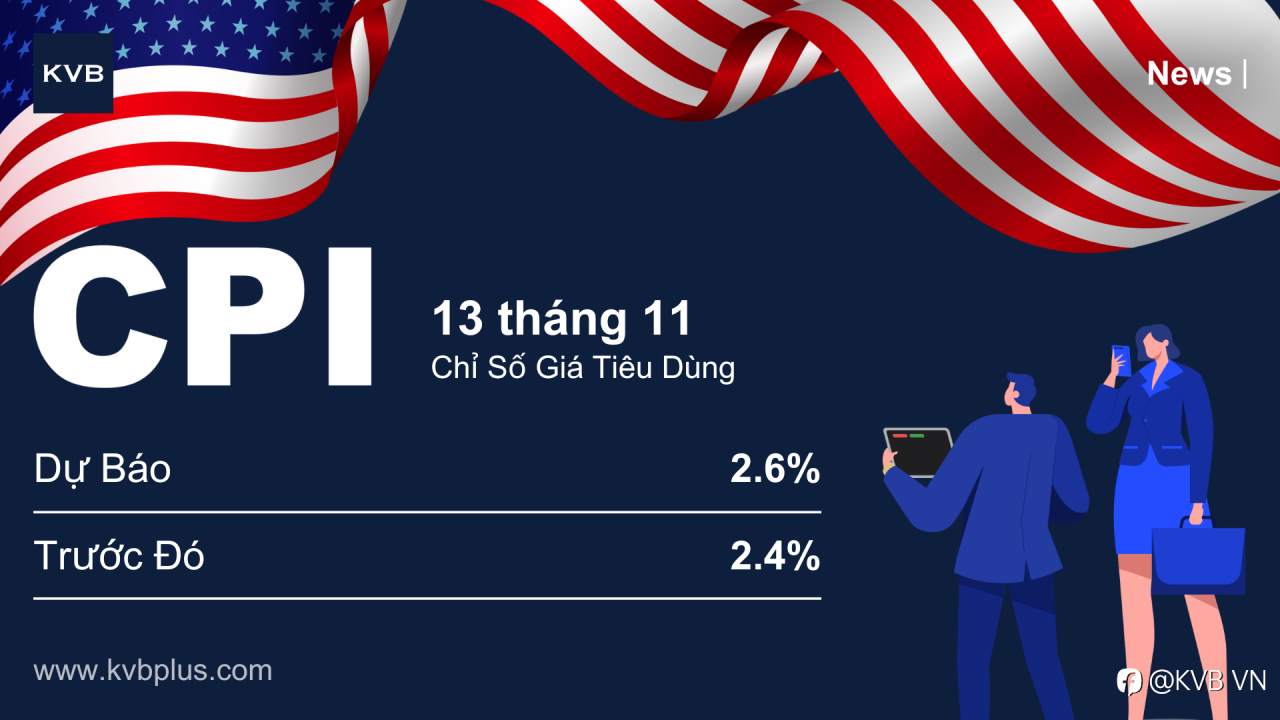

🇺🇸 Cập nhật lạm phát Mỹ: Chỉ số CPI tháng 10 tăng từ 2,4% lên 2,6%

🟢 Tăng trưởng hàng tháng: Chỉ số giá tiêu dùng (CPI) tăng 0,2% trong tháng 10, nâng tỷ lệ lạm phát hàng năm lên 2,6%, cao hơn một chút so với 2,4% của tháng 9. 🟢 CPI lõi tăng tốc: Loại trừ thực phẩm và năng lượng, CPI lõi tăng 0,3% trong tháng, đạt tỷ lệ hàng năm 3,3%, phản ánh áp lực giá cả trên

KVB VN

🇺🇸 US Inflation Update: October CPI Rises from 2.4% to 2.6%

🟢 Monthly Increase: The Consumer Price Index (CPI) rose by 0.2% in October, bringing the annual inflation rate up to 2.6%, slightly above September’s 2.4%. 🟢 Core CPI Acceleration: Excluding food and energy, Core CPI rose by 0.3% for the month, reaching an annual rate of 3.3%, reflecting broader p

KVB

🚨Latest update: Dollar tentative, yen eases amid uncertainty over Fed rate cut

The U.S. dollar traded within tight ranges on Monday, while the yen gave back some of last week’s safe-haven gains as markets awaited more clarity on the Federal Reserve's rate cut decision. With mixed signals from Friday's jobs data, investors are looking to this week's inflation report for further

上拉加载