#FOMCMinutes#

463 浏览

23 讨论

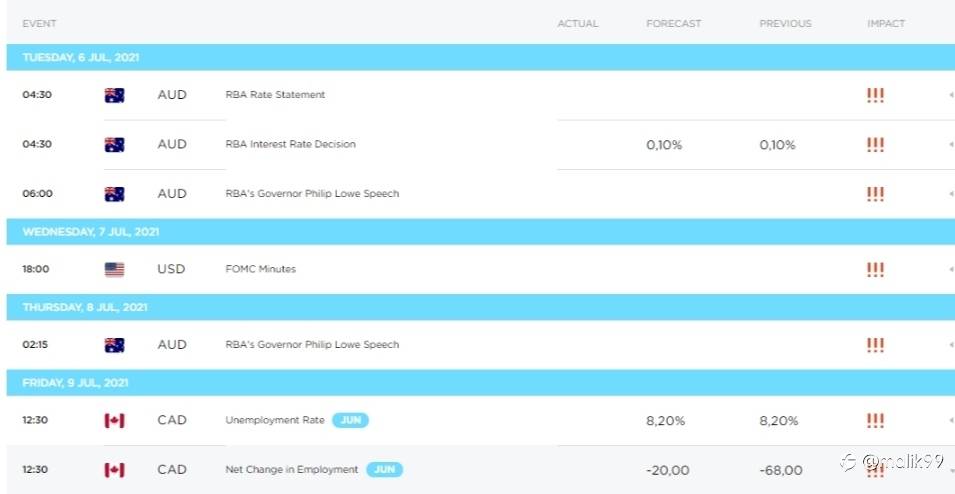

The minutes of the Federal Open Market Committee (FOMC) meeting are detailed records of the interest rate meeting held by the committee about two weeks ago. The minutes of the meeting contained FOMC's detailed views on monetary policy, so foreign exchange dealers combed them carefully to find clues about future interest rate trends.

FOMC TONE Technical Analysis, Friday, July 9, Canada Employment Change

The Canada Employment Report is published by Statistics Canada and measures changes in the number of people employed in Canada. In general, an increase in this indicator has positive implications for the cost of costumer spending that stimulates economic growth. Therefore, a high forecast is conside

FOMC TONE Technical Analysis, Tuesday, July 6, RBA Policy Rate

The Reserve Bank of Australia's Policy Rate is the overnight market interest rate, with the RBA acting as the central financial authority for the Australian economy. The Reserve Bank of Australia is expected to keep interest rates at this meeting and also discuss the Australian dollar. RBA policymak

FOMC TONE Technical Analysis, Thursday, July 8, US Continuing Jobless Claims

US Continuing Jobless Claims are published by the US Department of Labor and measure the number of people who are unemployed and currently receiving unemployment benefits. This represents a strengthening in the labor market. An increase in this indicator has an adverse impact on the cost of consumer

FOMC TONE Technical Analysis, Wednesday, July 7, FOMC Meeting Minutes

The Federal Open Market Committee holds 8 meetings a year and reviews economy and financial conditions, determines the appropriate stance of monetary policy and assesses risk to the long-term goals of price stability and sustainable economic growth. The FOMC Minutes are released by the Federal Reser

THE MINUTE OF THE FOMC MEETING WILL POSSIBLY DETERMINE THE MARKET TONE

Durung the upcoming trading week, the release of the FOMC Meeting Minutes from the june policy meeteng ia likely to set the tone for financial markets. Market participants are likely to anticipate a more aggressive tone from the US central bank. Trades and investors are also looking forward to a rat

READ N' GO-Daily News Recap

Good morning traders! This is the official account to find out all the breaking news that may/may not affect your trading decision such as economic policies, political moves, global agendas, and more. BUT first, to start off your day with a bang, here's a recap of the important news we think you sho

【Orbex基本面分析】非农数据对FOMC会议纪要的意义

通常情况下,交易员密切关注FOMC会议纪要的发布,以了解未来利率政策可能走向。 不过,这次情况可能略有不同。创造就业机会的数字已经连续两个月远超预期。 非农就业岗位创造净额不仅超过了乐观的估计,上个月的结果也有所提升。 为什么我们要关注 美联储的共识是,就业增长是首要问题。 一些成员甚至表示,他们愿意保持利率不变,并继续进行干预以促进就业,即使通胀开始攀升。就业数据如此乐观的事实可能是一个迹象,表明美联储将在短期内更从容地抑制潜在的通胀。此外,它还可以推进资产购买的预期“减量”。 这就是为什么上周五我们看到美国国债收益率上升,因为投资者对提前加息的可能性进行了定价。高收益率通常意味着美元走强,

【Orbex基本面分析】FOMC会议:明天会发生什么

自从上次在1月底的美国联邦公开市场委员会会议以来,发生了很多事情。 那时,美国的就业人数仍然没有回升。新闻界仍有报道说疫苗接种的问题,当时还不能确定1月7日是感染病例的实际高峰。 从那时起,许多关于这一疫情的疑虑得到了解决,以及应对这一问题的经济援助开支数额。 在最新的1.9万亿美元新冠救助开支获得通过后,美国总统拜登发表了更积极的讲话。他大胆猜测,到5月初,将有足够的疫苗使所有企业开业,到7月4日恢复正常。 不过,大多数投资者心中的问题是,“这对通胀意味着什么?” 美联储和市场意见相左 在本月早些时候《华尔街日报》的一次采访中,鲍威尔坚称,即使就业数据恢复到危机前的水平,美联储也不会加息。

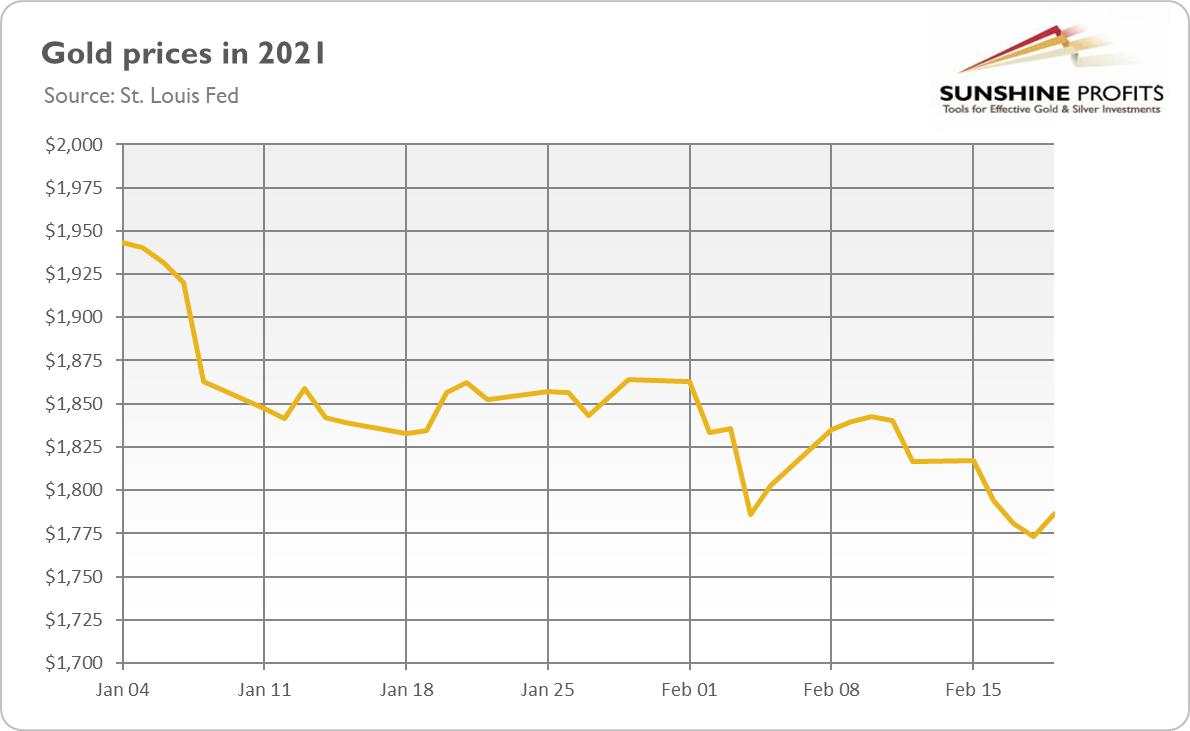

FOMC minutes disappoint gold bulls

The recent FOMC minutes are hawkish and negative for the price of gold, but the Fed will remain generally dovish for some time. Last week, the Federal Open Market Committee (FOMC) published minutes from its last meeting in January . They reveal that Fed officials became more optimistic about the eco

Forex Weekly Outlook: US dollar retreats, inflation on the move

The US dollar rally earlier this year has taken a pause, as other major currencies have made inroads against the US currency. Economic growth remains muted in the developed economies, although inflationary pressures have been increasing in Europe and in the US.This week’s highlights include US GDP a

FOMC Minutes: Too early to talk about tapering – UOB

Senior Economist at UOB Group Alvin Liew evaluates the latest publication of the FOMC Minutes of the January meeting. Key Quotes “The main takeaway from the Federal Reserve’s release of the January 2021 FOMC minutes (18 Feb) was the central bank’s reassurance that the Fed is keeping its easy monetar

Gold Price Analysis: Target achieved and fresh bear-cycle lows for 2021

Gold has dropped to 2021 lows and in doing so has completed another chapter of 'Gold Price Analysis'. The support structure on an hourly basis finally caved in, making way for the $1,765 weekly target. As per the prior analysis of Gold, Gold Price Analysis: Bears need break of current support for $1

上拉加载